So far the resiliency of the market since yesterday afternoon quite frankly is surprising.

All of the Index futures are slightly negative, but mostly in line intraday, here's a look at some other indications...

The SPY Arbitrage model shows the market getting some support, I'll check our own Leading Indicators next.

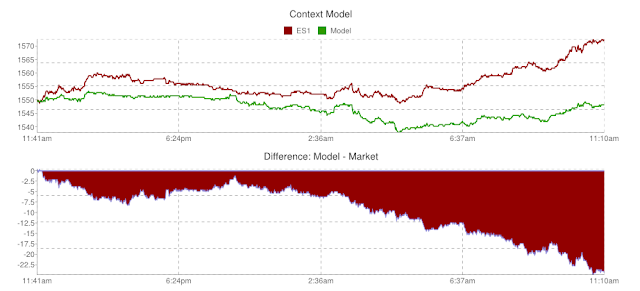

However, CONTEXT'S ES model has a 20+ point negative differential, this is not the consolidation/pullback I was expecting for today so I need to take a much closer look at Leading Indicators.

Volatility thus far is not really arguing much with the intraday direction of the market, there are some small differences, but nothing I'd make a call on.

SPY intraday 3 min as well as 1 and 2 min are all negative, at 5 min it is in line, every market average shows the exact same as far as timeframes today.

5 mon SPY momentum today, there's a slight fall off here as RSI and MACD are negative, but just slightly.

DIA 3 min

IWM 3 min

QQQ 3 min-the reason I use 3 min is because it is the longest intraday timeframe negative, 5 min charts are still in line with price, which is why I thought any pullback or consolidation in the market would be temporary.

The TICK data should be watched, it's definitely not in line with the trend of higher prices.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment