Honestly as far as looking forward for forecasting purposes, a positive divergence that tells us the market is going to be heading up, even while it's heading down or vice versa is much easier than a lateral market to forecast, I have to say and stick with the highest probabilities and the expectations of down, but I don't know if the choppy forecast was to close out October as best as they could and that would include the last week or so of market action on no volume and every trick in the book to hold the market up, I'm not sure if the chop is the best they can do to effect a market pin for op-ex today or if this will move along a little longer and act as a meat grinder taken to traders' portfolios.

Here's what I have this morning and I HAVE to give it to you as I get it because short term trade is moving around so fast. In the MCP post the market was doing one thing EXACTLY with EUR/JPY as I wrote it and then by the time I finished the post it was doing the exact opposite.

Lets start there.

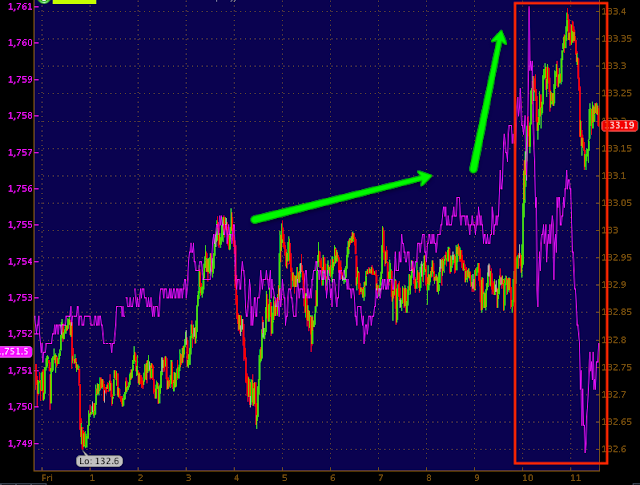

In the early hours of the a.m. (times below are EDT from midnight Thursday to nearly 12 p.m. today), EUR/JPY is the green/red candlesticks, ES (S&P E-mini futures) are purple, you can see the correlation overnight and as I was starting the MCP post the FX pair and ES both took off to the upside, then ES failed, we saw this earlier in the week too, the chart I said "Was not normal". It's my opinion that ES failed to follow the FX pair because of op-ex Friday, that's the simple answer, I may revise that as I find more, but that's my guess so if that is so, then around 2:30 or so "if" the EUR/JPY is higher, Es should make a move to catch up, if not, then wherever EUR/JPY is should be the magnet.

Averages IWM

Intraday 1 min is a weak relative positive, I think again this is just to steer the market on an op-ex pin.

IWM 3 min inrtraday has been in line

And this 30 min chart really stood out. First note the range, it seems like the market was moving up non-stop if you watch the market every minute all week, but that's a range and it's very similar to a very low VIX/VXX range indicating complacency, usually the mix in a situation like this is disaster for the market, but we'll look closer at VIX.

Second the ROC of 3C on the downside the last 2 days is extreme, looks like heavy distribution on top of what was already heavy, but the ROC has increased.

QQQ

1 min QQQ relative positive like the IWM, again most likely intraday steering changes made by market makers/specialists for op-ex for now.

QQQ 2 min looks as if there's some element trying to slow down the near term downside, again I'd think because of the max pain pin level.

And the 5 min chart has maintained a strong ROC on 3C downside, again note the range, it is in these ranges we see some of the strongest accumulation / distribution.

SPY

1 min intraday exactly the same,same reason I suppose.

The range in the SPY and the ROC of 3C downside is impressive and makes me think that unless something changes significantly later in the afternoon, the chop resolves to the downside in which case I'm still very happy yo have chosen 2-3x leveraged short ETFs rather than options as they'd be bleeding right now.

The Russell 3000 and my Most Shorted Index (red)

For a long time the momentum monkeys played the Most Shorted stocks because the squeezes were giving them great momentum moves on the upside, but there's a reason I don't go long in a weak environment, it's because I've seen months worth of gains wiped out on an opening gap out of nowhere or at least it would appear.

The MSI is significantly underperforming the Russell 3000 Index, but the other side of that coin is at some point we either get an oversold bounce or we get the breaking dam. I can't imagine the momo monkeys who must expect these shorts to come back on no QE taper are hurting pretty bad. Hindsight on a chart is always 20/20, but living at the right edge is far different and people assume the momo monkeys are long gone, that's not the case from some of the comments I have seen, they got caught with the idea that what worked for the last several weeks/months would continue to work until they got buries too deep and now don't want to move/cover. That's the market working at its best.

NYSE TICK

For the last couple of weeks it has been very mellow at +/- 750, we hit an extreme of -1750 this week, I haven't seen that since May as far as I recall, the 22nd.

Even today we are pretty extreme on the negative side around -1250.

My Custom TICK Indicator

Again the cycle or trend off 10/9 lows shows the breadth of the market pretty well, just look at the histogram at the bottom, up early in the trend and then down.

VXX short term volatility

This has been dull intraday the last couple of days, strangely, but it seems that protection is once again under accumulation/being bid on the 2 min

The trend has shown accumulation, remember the flat range in the averages, well look at the VXX, and recall what I said about flat ranges. The trend of positive divegrence is clear, now the increased 3C ROC is clear just as the chart above so it "seems" someone is making final preparations as it can't be said they haven;t been making them for a while now, in fact since that day I first saw everything go haywire, Friday 10/18.

The larger intermediate 10 min trend

The there's HYG Credit which is a "Hail Mary" they go to for market support.

I think the 2 min trend above is accurate, but there is some effort to stabilize credit at least for today.

That is evident on the 1 min chart, this is a good example as well as to how much actual difference there is in underlying trade between a 1 and 2 min chart, on the 2 min it shows up as a much smaller area.

The 3 min shows distribution and overall in line, I suspect HYG continues lower, but it seems to also being used to steer the market for today, maybe a bit longer if there's plans to continue chop.

The hard part is answering the question, "What does SHORT TERM TRADE LOOK LIKE out of the chop?" I think the easier question is what does intermediate trade look like moving forward, thus the 2-3x leveraged shorts that can be left in place without all the work options would take to work around chop and just stay with probabilities.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment