I have liked the set up developing in USO for quite a while now, it has built a respectable reversal process and leading positive divergences, I think USO can move in to the channel easily and as a counter trend rally, I think that's what it's aiming for, thus the larger footprint for a base.

In addition, counter trend moves are some of the strongest when they are counter trend rallies. I have the December $35 calls still open and at the right time, may even add to those, but I'd like to have an asset that is better for trending, like a 2-3x leveraged long ETF, I like UCO (2x DJ Crude) just because it has better liquidity than most other ETF/ETNs.

I'm VERY close to adding such a position (trading), but would like to see just a few more signals really pop and who knows what Bernie says tonight and how the $USD reacts as oil is sensitive to the $USD movements via legacy arbitrage.

60 min USO chart is beautiful, I'm thinking the target will be in the $38 area, maybe more.

The foot-print of the base is significant and beautifully formed as are the divergences during that area.

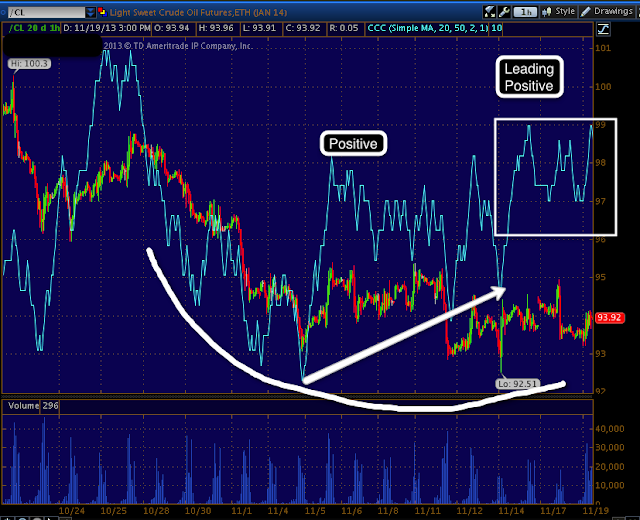

This is the 2 min trend from in line on the downtrend or confirmation of the downtrend to accumulation in white at the rounding area.

This is a close up of the same chart, if this were just leading a bit more and popped off the chart, I'd be looking at opening or adding to USO long positions.

The 15 min Crude (/CL) futures look fantastic, this is what I'd like to see in USO.

The longer term 60 min futures look similar to USO which couldn't be unless there was something three considering they are different 3C codes, they are Brent vs. USO and futures vs and ETF, that's good confirmation.

Still loving oil long.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment