Gold is historically bought before inflation, but on inflation expectations. We'll delve further in to what inflation expectations are present or likely to soon be present.

At #3 we saw the accumulation as price neared a "W" bottom and larger base, at "4" in yellow the typical head fake we'd expect to see at a "W" bottom, but "5" was something extra.

The 30 min chart shows the entire area as being accumulated including the recent lower low. but this may not have enough detail.

At 15 we see the specific place that the move under support was put together, the 14- 18th and as price moved below, the accumulation of lower prices as this is one of several reasons for these moves.

Here on a 5 min chart we have a lot more detail, we can see the negative to drive price below support to the left and accumulation of that move below at the white arrow.

2 min chart shows the EXACT SAME THING.

And the 1 min chart confirms with detail what I hoped to see.

And the 1 min chart confirms with detail what I hoped to see.As for Gold futures, something bigger is going on here and I've been thinking that for about 5 months as GLD has been getting itself together out of a downtrend.

Gold futures 1 day

4 hours showing where base #1 and the second base were as well as the break below the support area.

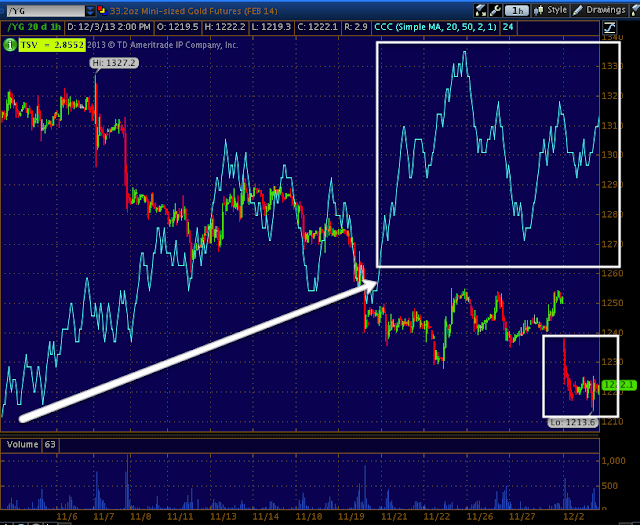

60 min chart

30 min chart

15 min chart

There seems to be more than enough reasons to take on a gold position, I'll leave calls in place and watch GDX carefully.

When we have more time we'll get in to why gold may be entering a new bull market and what the inflation expectations are that could drive it, I'm guessing "Stag-flation"

No comments:

Post a Comment