I can't really do much with the trading portfolio regarding PCLN as I set it up so there's no options trading there, just equities, so my choice is to cover PCLN short at a small gain and go long, then flip back short in what will probably be a very short duration trade above $1200. However for me it's just not worth it, the options position opened yesterday is another story, I might add to that, but it's in the options portfolio so it can't act as a true hedge (this is all just relevant to what I have set up), for you it could.

I think it's probably worth a shot if you have that kind of risk tolerance which I do.

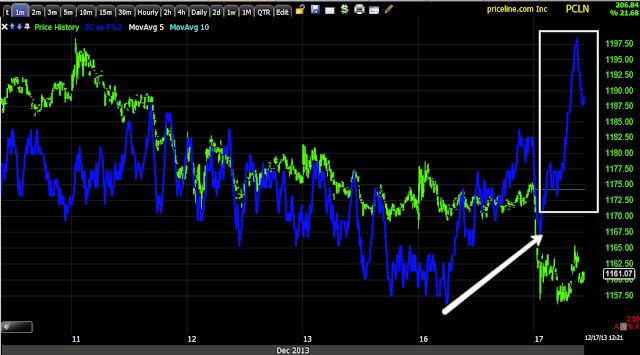

Here's the improvement in PCLN for that specific trade and then we get to the first ugly chart and they get much worse from there, that's the probabilities, that's why PCLN short was left in place when all other trading positions went long in the trading portfolio, it's because I believe in this as a short and I think it makes a nasty fall when this bounce gets done, as confusing and ugly as it may seem (the bounce).

1 min intraday leading positive even more, that means the move this morning was likely a head fake, as we saw it hit stops and probably got some shorts involved so as a head fake move it did what it was designed to do and as a 3C chart, we have good confirmation it was a head fake move which is a broad term for different manipulative strategies like stop runs which is actually what this is or a bear trap.

There's support for the 1 min divergence here at 2 min

And clearly improving at 5 min.

That's where it end, as I said last week, the divergences are 1-5 min and that's about it, that means bounce and the roof or lid on that bounce starts right below.

10 min leading negative, but every timeframe above this is as bad or worse so for an equity position, swing trade or longer, you may have to sit out some draw down, but if you want to trade the probabilities, it's short.

If you're not in or in a partial position, good for you because any move >$1200 which for me is just a magnet for price, is an excellent entry, I'd take it all day long and twice on sunday if the market was open.

Otherwise if you have the risk tolerance, I think calls will work, I'd want something longer than a weekly, but that's me, I'm not looking for a lotto ticket.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment