There's still an obvious Arbitrage set up in play (HYG/VXX).

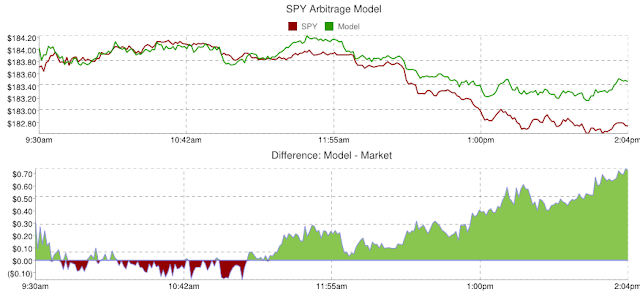

The SPY Arbitrage model is at +.70, the bulk of that as you can see is the dislocation if the SPY (red line) while the arbitrage component (green line HYG/VXX) remains fairly neutral, which is the same situation we saw on Friday.

As far as Leading Indicators, they seem to indicate as I said before, a panic more than anything.

HYG outperformance vs SPX

Here I've inverted the green SPX price so you can see the relative performance of VXX, the correlation would normally be 1.0 so they'd move together, VXX is lagging the SPX a bit which isn't surprising if it goes to broaden out a short term reversal base/process as as been mentioned several times today.

Sentiment as I pointed out in last night's post is getting chilly and was leading the SPX, they've caught down to each other in a short term reversion to the mean.

I also mentioned last night how Yields which are an excellent leading indicator were dislocated to the downside and they act as a magnet for equity prices which fell right to the short term regression to the mean, longer term the SPX has quite some way to go on the downside before catching down to Yields.

The Yen is still strong, but on an intraday basis is parabolic, it looks over-extended and it wouldn't be surprising to see it correct which would fit the SPY Arbitrage set up and many other indications today, THIS IS WHY WE DON'T CHASE PRICE AND DON'T MAKE LONG TERM DECISIONS BASED ON SHORT TERM ACTION.

USD/JPY has made a new low at $102.84 from over $105 on Friday, that's a lot of distance to cover in 1 trading day. The BOJ will start becoming more and more concerned the closer the pair moves toward 100 and may step in with some intervention which has either had a very short half-life in the recent past or has not been effective at all.

It does look however, as if there's a consolidation area intraday in this pair and EUR/JPY which hit a new low for the year today at $140.48

Both VIX Futures and VXX or UVXY have seen continued, extra strong leading positive divergences today, it would be great if the price action created enough of a lateral range/base for price to give the same support as these leading positive divergences and a market intraday bounce could achieve that.

The thing that we now need to add to the list of "Things to watch" is now market character and behavior. We know how it has acted in the past with proportional reversal processes, head fake moves, etc. We need to see if there is a new dynamic in play, if so, figure it out quickly and adjust. I doubt things change too much, but I do expect volatility gets really silly.

As for the averages, the earlier 1 min mostly and one 2 min chart positives that were starting to form in the averages are completely washed away.

Index futures on the 1 min chart are a mixed bag, there's nothing there on the positive side that I'd relay on or even post as an intraday update.

This is exactly the dynamic that I described Friday in my complete unwillingness to even consider a long position or a hedge for the trading portfolio which is leaning strongly bearish.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment