As far as this mornings USD/JPY and SPX expectations, we're pretty much on track.

As far as GLD, yesterday I was very interested in GLD short with 2x leverage, DZZ long, but I refuse to chase anything and wouldn't even consider a partial entry, that's because Technical Analysis is used against us so often it's predictable. My plan yesterday was to wait for GLD to bounce and short in to that, if I missed the trade, so be it, but to take on a sub-par entry with increased risk is just what I said I was feeling about the position yesterday, GREED and that's an emotion and the last thing I want to do is make emotional trades rather than objective based trades.

GLD should move with the SPX as it has on this entire run, we'll see what happens to the correlation after, but for now, if you know what the SPX is likely yo do, you have a good idea of the directionality of GLD.

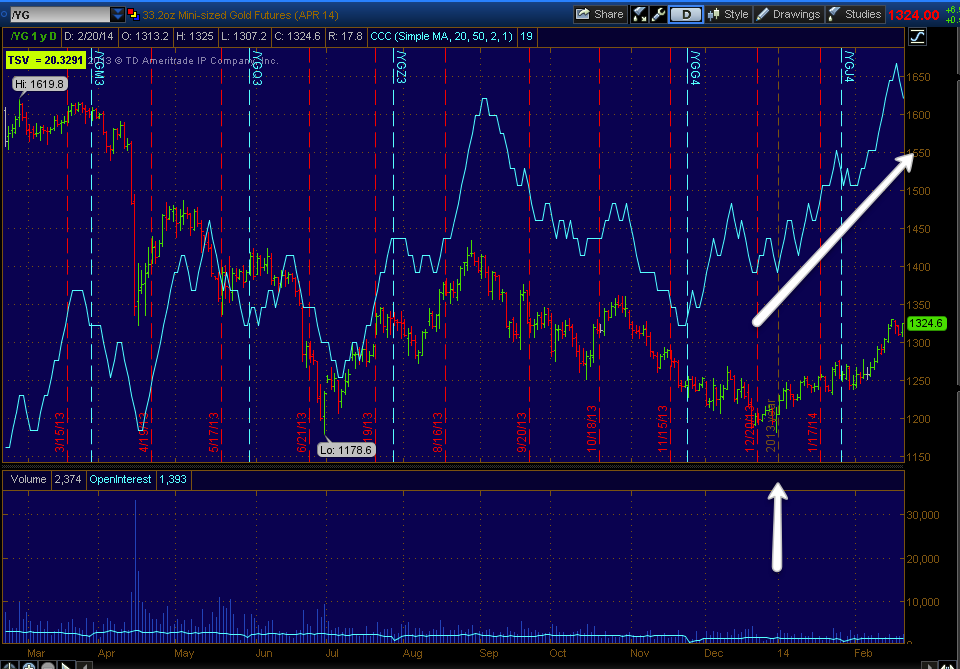

The charts as GLD did start to make that move I was hoping for yesterday.

As pointed out yesterday, GLD looks like a great long term trend trade (long), but it needs to pullback first, the pullback is the trade I'm looking for, when we get to the bottom we can look at GLD as a long term trend trade.

Remember the gap and bearish candlesticks in GLD in this area? Then yesterday some downside, this is the downside that I refuse to chase and today is a perfect example as to why. This is the kind of move I was hoping to see, it just took a little patience and maybe a little more.

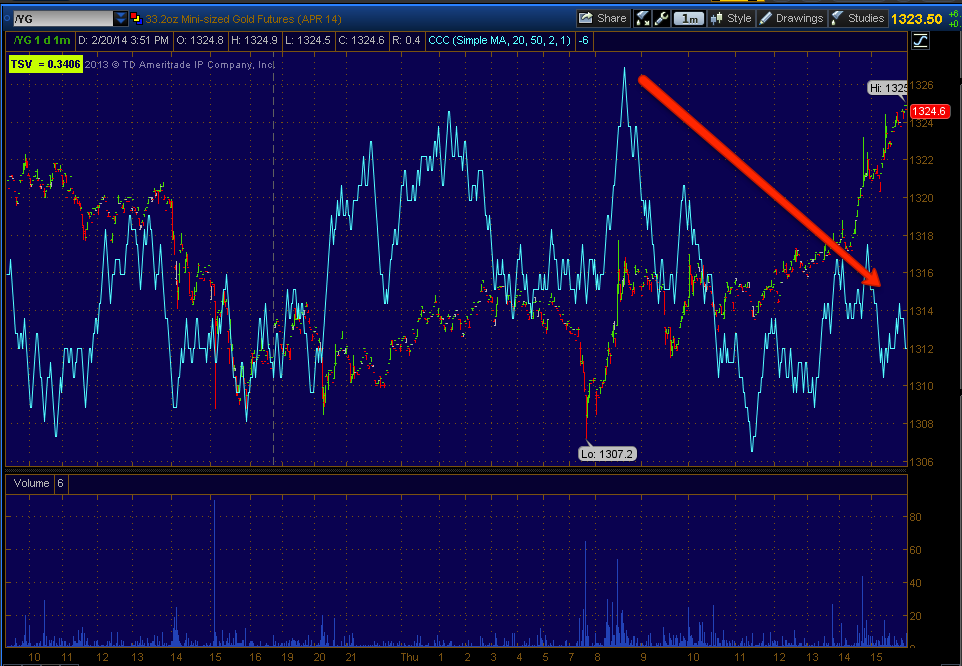

This is an ugly chart, but still shorter term as far as the type of trade, it's not so short in duration that I think options are needed, but I'd like to have at least 2-3x leverage and since the only leveraged short ETF/ETN with any kind of volume is DZZ, that's the asset I'm looking to go long at the right moment (2x leverage short GLD).

When this 2 min intraday chart goes negative (it's nearly perfectly in line-intraday), that''s the cue to enter DZZ long.

I also looked at Gold Futures to confirm what I was seeing in GLD the ETF...

The daily chart of gold futures has a huge leading positive divegrence so once again, as a long term trend trade I'd like to go long GLD without any leverage, but first it needs a pullback and that's the move I'm looking to trade using DZZ.

The 30 min chart in gold futures suggests gold futures/GLD will pullback, that makes the DZZ trade work and that helps get us to a more reasonable area for a long term trend trade in GLD.

Intraday 1 min gold futures are seeing some distribution in to the move up which is somewhat parabolic, the fact they seem to be distributing in to any sharp move up immediately suggests the DZZ long position should be available very soon, I'd think tomorrow if it weren't an options expiration Friday in which they'll look to pin the market.

This is why there are certain concepts like NOT chasing prices, but letting them come to you. This is the opposite of a century of Technical Analysis teachings, but those are so consistent that they are predictable, I can predict them, Wall St. is even better especially as they have the full book available to them and know where any and every order that has been put in rests.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment