I have reiterated the long idea on both GLD and GDX (actually their 3x leveraged ETFs, UGLD and NUGT) so many times the past couple of days I figured I'd post something different so you don't just see it as another "Reiteration" and pass it y.

Both are positions I like a lot, I think Gold has a primary bull trend coming, I don't think this is it, this looks more like a counter trend rally as gold eventually moves to its longer term base, but counter trend moves are some of the strongest out there. After the initial break of the Dow in 1929, the first counter trend rally would have thrown a lot of traders off as it lasted nearly 6 months and gained over 50%! This is why I love bear markets, fear is stronger than greed and sends assets down hard and fast and the counter trend rallies in a bear market are stronger than a bull market rally.

Here's a look at both assets, I have open longs in both.

Gold Miners, even though the ETFs track each other, because their volume is different, there won't be confirmation among signals unless there is actually something going on, that's what "3C" stands for, a reminder to "Compare, Compare, Compare".

NUGT

1 min intraday positive

5 min, the trend here is obvious, the reversal process is mature and the divergence leading positive.

NUGT 10 min, all the same can be said for the 10 min chart.

Even all the way out to 30 min (this is why I think this is counter trend and NOT the start of the primary bull trend I expect in Gold which is probably 6 months off) we have a positive divegrence, that's strong for a CT trade, take a closer look...

NUGT 30 min leading positive which means some pretty heavy underlying accumulation took place here, this is likely going to be more than a swing trade.

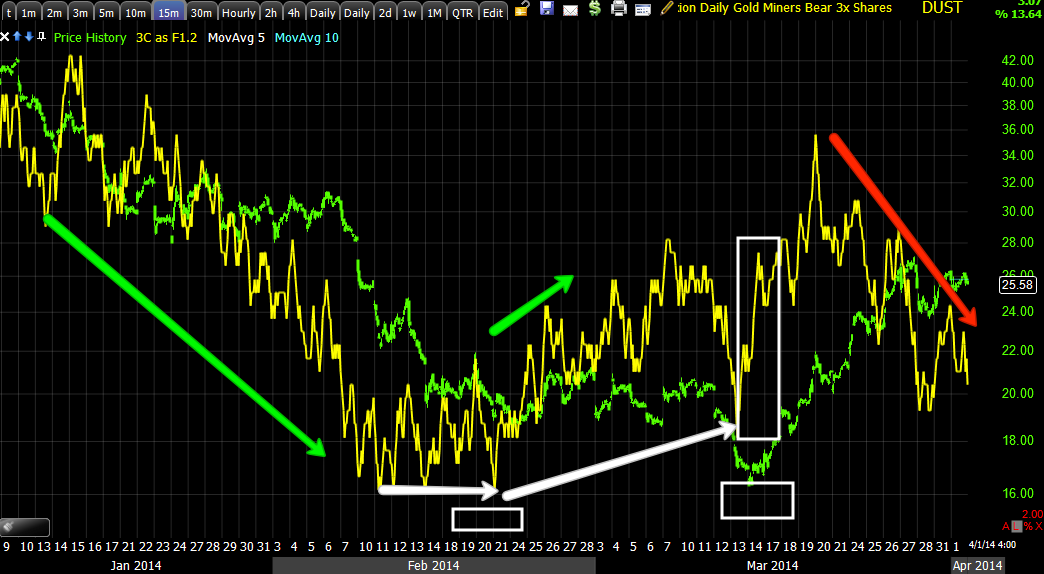

Compare to DUST's (Gold miners 3x short) chart.

It's nearly the mirror opposite with a 30 min leading negative divegrence.

DUST 1 min intraday leading negative

DUST 5 min cycle from accumulation to distribution, leading negative.

DUST 15 min, in line downtrend, accumulation and distribution.

GLD

5 min leading positive

UGLD (3x long GLD) 5 min leading positive divegrence.

GLD 10 min leading positive

UGLD 15 min Leading positive

GLD's main base to the left, I think we see GLD tag those prices and form a large "W" base around the $115 level before a primary uptrend begins, making the current expected move a counter trend rally or what some would call an oversold rally, but it's really not an oversold condition.

A closer look at the GLD 60 min chart, so some accumulation reached all the way out to the 60 min which is very strong for a counter trend move.

CAN'T WAIT!!!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment