Overnight Index futures have been practically unchanged ahead of today's Quadruple Witching expiration, there's some movement to the upside the past few minutes.

USD/JPY was lifted right back to $102 overnight, there's very little doubt who's behind the move, the Bank of Japan which does not want to see the Yen move too far away from the $102 band.

USD/JPY overnight right to $102.08

The correlation value of the USD/JPY since the market made its move above $SPX 1900/ the 3-month range, has been very low...

I suspect most of this range is all BOJ lifting bids to keep the pair around $102, otherwise I'd guess the carry trade is being sold off, it certainly isn't following ES (purple)/SPX futures.

Since the same move in ES/SPX the EUR/JPY carry trade has gone in the opposite direction, certainly being sold off.

The closest of the carry pairs is AUD/JPY as the RBA's minutes have been more dovish than expected, but even in that case, over the same period, the AUD/JPY hasn't been able to break above its early April highs, so it's not been keeping pace either.

It wasn't that long ago (a bit over a year or so) that all 3 carry trades moved up in a trend, almost in unison, since then they've flatlined.

weekly chart showing AUD/JPY vs USD/JPY in unison until about last April 2013 when they started trending sideways after 3 years of trending up.

Yesterday of the 9 S&P sectors, the best performer was, you might have guessed it, the Safe-Haven Utilities sector (+.80%) with Consumer Discretionary, Materials, Technology and Financials all closing in the red. There have been at least 3-days this week to my recollection that Utilities have been the best performer, one day they doubled the performance of any other group. The defensive Utilities are up +3.67% this week, tripling the performance of the S&P.

Gold was largely flat overnight which concerns me a bit about a GLD/GDX/NUGT (especially NUGT) pullback, even though I don't have any concerns about NUGT's trend, I'd rather not have dead money through drawdown of a pullback, at the same time I don't want to miss the forest for the tees like the AAPL short when it was at its all time highs. AAPL is another I'll be watching closely today as it hasn't bounced yet as expected for the week.

Weekly chart of gold futures, we have nearly a year's worth of accumulation and base, initially when we first saw it I assumed it was accumulation for a counter trend rally within gold's downtrend from the 2011 highs, but as this base has grown to this size, it's clear this is something much bigger and as we have seen recently, gold miners are once again starting to lead gold, a correlation that use to be the norm before QE and seems to be returning as QE is tapered out, as I said before, I think a lot of things will change including volume analysis which I suspect most new traders of the last 5 years have no idea about. I use to say if I could only have two indicators they'd be candlesticks and volume, that hasn't been true under the QE regime, but it seems like it will be again and I'd still go with the same two indicators. The art of volume analysis is subtle, but there's so much information to be gained now that it's starting to matter as QE won't be around much longer.

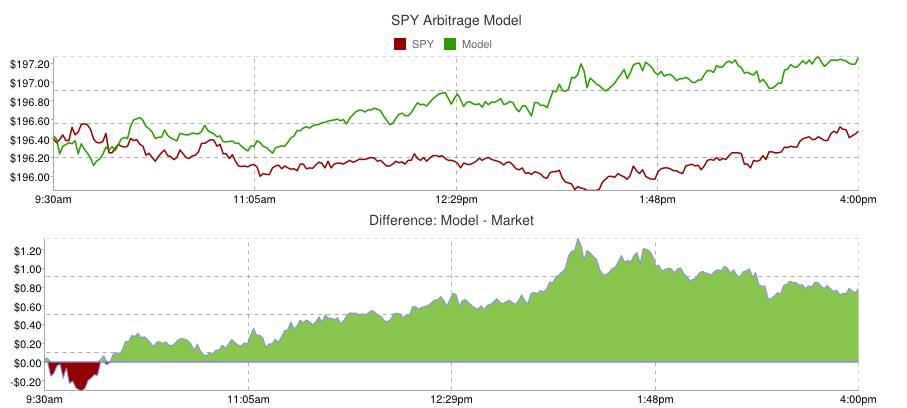

It is of note that yesterday at the close the VIX was not monkey hammered as is the closing norm, rather it gained through the final hour of trade. I'm a little interested in how the week ends (today at the close) as far as the VIX is concerned which is near single digits, it's pretty hard to whack-a-mole the VIX when it's in single digits, the market losing another lever perhaps as yesterday's massive SPY Arbitrage which was positive by $1.20 SPY points at one point in the day was unable to do much, it moved the SPX a whole of +0.13%

Yesterday's SPY Arbitrage model.

As for today's main events, obviously the once a quarter Quadruple Witching, when stock index futures, stock index options, stock options and single stock futures all expire the same day, the 3rd Friday of June (once a quarter), this is usually accompanied by a rise in volatility as well as volume. We also have SPY going ex-dividend today, if your short SPY you pay the dividend. The S&P is also rebalanced today, typically further adding to volatility and volume.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment