Yesterday's move up and the move to $IWM $118, which actually is more effective as a bull trap the higher it goes and the more longs it pulls in, was just the first half of the forecast which so far has not only given us the evidence to back up the theory, but the moves in the market to back it up.

However don't forget, that as bullish as yesterday's move was, this is a bull trap, that is the forecast, sending the market to new lows.

The Index futures, the market averages and the levers such as HYG are all on the right side today showing me that the forecast continues to provide evidence that the second half of it is correct as well and we are moving toward it just as Monday's move under the IWM's 6 trading week range was actually a bullish event that led to yesterday's move, much as yesterday's move will turn out to be a bearish event leading to new market lows.

Leading Indicators are the 3rd major post today to confirm that everything is moving in the direction anticipated, a bit earlier than I expected it to start, but also moving at a rather slow pace as well, so I guess it evens out in the middle.

Leading Indicators...

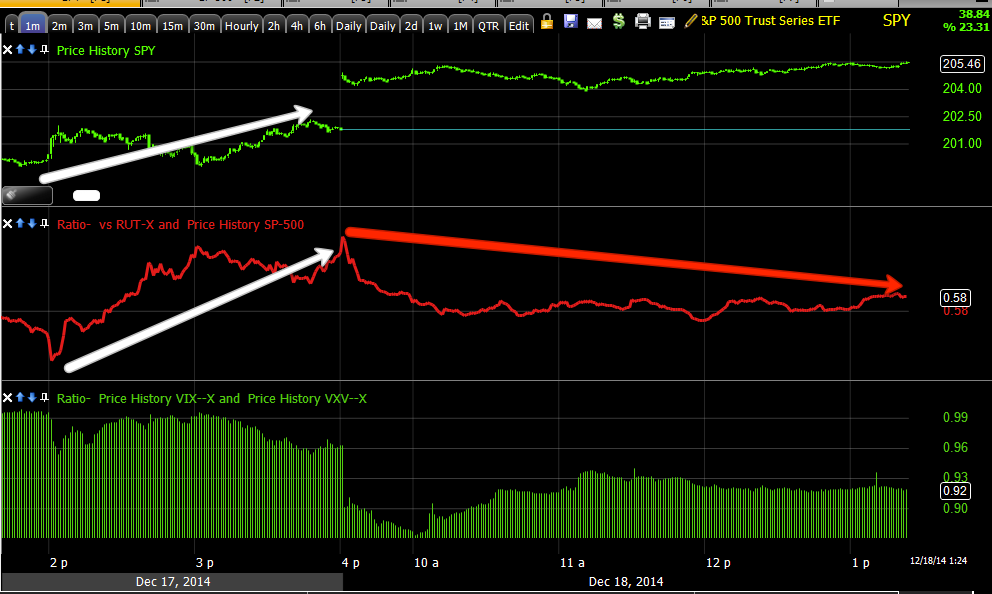

Our custom indicators, SPX/RUT Ratio (red) and VIX Term Structure (white/green) were both positive, giving the market support for an upside move since last week , even with buy signals in white that haven't been seen since the October lows, although no where near as big as the October or August lows, but in line with some signals before that which led to 3-4% moves.

Today is the first day I recall this week that the indicators are not only not leading the market positive, but they are not confirming the price action today, thus they are turning negative which is impressive as they were so unwavering in their signal in the run up to yesterday.

HYG which I said, "There's only one reason to accumulate HYG" and that's to ramp the market, is not useful in ramping the market by accumulation alone, it's only by HYG leading the market as it did at the whole arrows, making a higher low than the SPX leading it higher yesterday and then leading throughout the day.

HYG is now leading the market to the downside or at least failing to confirm. This should get worse as distribution in HYG continues.

In addition, HY Credit which is NOT used to ramp the market, but is still an excellent leading indicator, is failing to confirm today and not following equities exuberance both in HY Junk credit

And in PIMCO's HY Fund.

The VXX/Short term VIX futures is out performing the SPX today as well (note SPX prices are inverted to show the normal correlation).

Spot VIX is also showing dramatically better relative performance than SPX today as well.

Our pro sentiment indicator that has moved down every day despite any bounces in the market , as a leading indicator, did go positive for yesterday, but it is already failing to confirm today.

A closer look, pro sentiment is not willing to chase prices any higher.

Commodities as well, a risk asset, but one reflecting a dramatically slowing global economy , didn't move at all with the market yesterday nor today and as you see, they did lead it to the downside.

5 year yields are leading intraday a bit, but...

Just like we saw at the last two F_O_M_C meetings., 30 year yields are beginning to diverge from the market. the last two times this happened , the knee jerk gains in the market were completely erased only to move to lower lows, so I'll be watching this one especially close.

Again, so far everything is exactly as it should be for our forecast to finish strong.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment