You may recall that part of our December 12th (Friday) forecast was not only for the Russell 2000 to break above its 6 week trading range which it did, but that this would be a false breakout that would not hold and that the Santa Claus rally that traders assume as a birth right would be part of the trap that locks bulls in.

More specifically, the pop above the range in to the Santa Claus rally season would just bring more bulls in to the market as they assume like most years, they'll get the seasonal rally, our take from the charts and mass psychology was that this assumption that is widely held would be used against traders and the Santa rally would FAIL.

This is one of numerous depictions of what we expected in to the Santa Claus rally, from the December 26th A.M. UPDATE

" Today is the first day of the "Traditional" Santa Claus rally. You may remember that part of my theory with regard to this recent move up that was posted a week ago last Friday was that it coincide with the Santa Rally which is the week of Christmas (day after) through New Years, and the possibility if not probability that traders would be lulled in to the rally as they believe it's a near God-given right that MUST occur, with any sudden drop during this period likely to cause some intense downside action/pain. so it will be an interesting time moving forward through New Year's."

Taking the broadest definition of the Santa Claus rally (as there are at least 3 generally accepted periods with a little variation), the day before X-mas to the second trading day of January, this year's Santa Claus rally was the worst in 15 years or since 1999. It would seem that our forecast that not only would the breakout above the IWM range not hold (rather act as a means to an end in which the market moves lower), but that once again, Wall St. would use the predictability of traders and turn it on them.

The Santa Claus Rally... (SPX/Dow-30/NDX/Russell 2000/Transports)

FAIL

For the SPX, 7-days of gains, about +3.6% were almost entirely erased over the last 4 days (-3.34%).

As we also expected, I don't think it will take long before we take back all of the December 17th F_O_M_C knee-jerk gains, of course there's a much deeper downside target for all of this.

Europe was an absolute mess today, the amped up Greek Euro-area exit rhetoric was flying at new levels over the weekend, taken with the strongest country in the Euo-zone, Germany in an apparent deflationary spiral along with the rest of Europe. When the market reacted to Draghi last week on news that the ECB is in complete agreement that they need to act on deflation, with Reuters' help, the market took that as imminent QE, Germany then put the slap down on Draghi directly and we know from the near mutiny Draghi has on his hands, despite what Reuters may want to try to spin, the governing ECB council is FAR from agreement on QE as we saw with Merkel's economic advisor warning last week in a direct Draghi smack-down.

I stopped covering the details of the consequences of a Greek exit a while ago because it's very complicated and more academic, but it would have huge consequences for banks across Europe and perhaps most importantly consequences for ECB funding which in many ways is channelled through Greece in the form of bailouts which aren't actually bailouts, but payments of existing debt, interest and ECB funding via the IMF and the Troika so this is more than just whether or not Greece survives in the Eurozone as things heated up when there were 3 failed presidential elections causing snap elections rto be held soon in which the anti-austerity party, Syriza looks to garner control over Greece and give the EU a very hard time if not an exit.

Here's how European markets closed earlier today, Euro-Stoxx 50 -3.70%, FTSE 100 -2%, CAC-40 -3.31%, DAX -2.99%, IBEX -3.45%, FTSE MIB -4.92%.

For our part, not a whole lot better than some of the larger European markets, SPX- 1,83%, Dow Indu -1.86%, Dow Transports -2.66%, NDX 100 -1.64% and the Russell 2000 -1.46% AND THAT TO CAP OFF THE SANTA RALLY!

As for the close, we are so use to the late day ramp or attempt, some call this a failure of a late day ramp.

I'm not convinced that is what this was, in fact I don't see any evidence of it specifically like disproportionate VXX/TLT distribution, HYG accumulation or USD/JPY being ramped. All of the normal tell-tale signs of a ramp using levers are absent. I suspect "if" anything, this was just part of a more lateral basing operation that started late last week. although the post EU close bounce is a bit harder to discredit even though it was inconsequential.

I showed some charts today with some popular moving averages and where each major average was in relationship. The SPX closed below the 22 and 50 day today, the Dow took out the same with the break of the 50-day being the first time since just before the F_O_M_C. The NDX took out its 50-day and the RUT took out its 22-day, but held the 50-day. These are important levels for technical traders and I notice it's not uncommon to see price linger in the area after an initial break or cross back and forth a few times. However the break of the IWM and hitting stops at $117.50, even though it closed off its lows and used the 50-day for support, is really where I have expected a downside trigger to engage sending the market sharply lower.

The 10 and 30 year yields are now below the level from the F_O_M_C with the 10 year closing at 2.039% and the 30-year at 2.605%. I do believe that it won't take long for stocks to catch down as I had mentioned late last week that ES/SPX futures was catching down to USD/JPY, today it finished the job.

The exuberance in SPX futures was pared as it caught down to the USD/JPY correlation today (60 min chart).

Intraday the USD/JPY (Candlesticks ) and Es (purple) were pretty tightly correlated which may tell us something about a potential bounce which I'll get to in a moment.

To give you the quickest, easiest view of the market, I'll just use the averages which suggest either a bounce starting tomorrow or a wider base continuing and a bounce, I lean toward a bounce starting tomorrow.

5 min SPY positive from last week and today suggests a near term bounce, it does not suggest a very long bounce, although every bounce has a job to do and that's to be convincing.

There's no doubt which way probabilities lay as the 30 min SPY is deeply leading negative at new lows.

The 5 min QQQ also shows a bounce off a positive divegrence started last week, as does the IWM, but again...

The 10 and 15 min charts (IWM 15 min above) are very negative, thus capping any upside and putting probabilities firmly to the downside.

While this may seem unconnected to near term market action, I don't think it is, check out the charts, I'll explain at the end.

Currency Futures

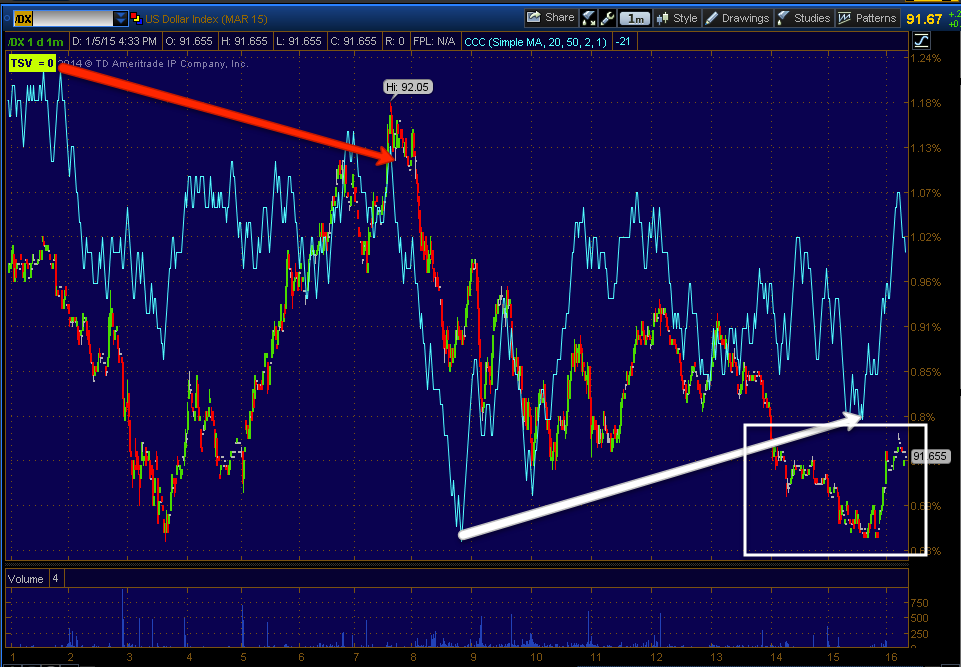

The 1 min $USDX shows a slight positive divgerence, I think it is probable that this grows overnight.

However the 5 min $USDX is actually quite negative.

As is the 7 min $USDX.

A rising $USDX short term would lift index futures/the market as you saw the ES vs. USD/JPY correlation above, however I don't see this as a very long bounce right now because of the 5 and 7 min negative divergences, in fact it looks to be quite short term (possibly day or so).

The 15-30 min $USDX are both negative, from 5-30 min the $USDX is negative suggesting a deeper pullback, likely taking USD/JPY lower with it which would fit nicely with out market expectations, a short term bounce and continued move lower, this is why I have no interest in trying to play a bounce, it makes no sense to me.

The longer term 60 min $USDX looks like it very well could head higher, but not before a mid-term pullback which the 60 min chart seems to be indicating as well as the 5 min- 30 min $USDX charts, again, that would likely mean USD/JPY lower and Index futures/market lower as we have expected.

The 1 min Yen is pretty noisy, but the 5 min suggests a near term Yen pullback which would be the short term boost to the USD/JPY that Index futures could use for their short term bounce, however, at the 5, 7 and 15 min Yen charts, they are all positive, almost a perfect fit for the USDX charts and the idea of a very short term bounce in USD/JPY and the market followed by deeper downside.

Here's the 30 min Yen positive which would mean a lower USD/JPY pout to longer term charts, again right in line with market expectations of a lower low below the October lows.

The 60 min Yen is also positive, just remember, the Yen moving up is negative for the USD/JPY and the market if it is still correlated to it as it usually is, thus the $USDX and Yen charts both suggest a near term, short bounce followed by renewed downside and I suspect much heavier downside as the IWM cleanly takes out all of the longs in the trap.

Even the 4 hour Yen looks very strong here, this has been one of my macro themes, a stronger Yen/weaker market.

As for the EUR/USD or the Euro in particular as you can apply the $USD charts, a weaker Euro typically means a stronger $USD and vice versa which has an effect of course on the USD/JPY pair outside the Yen and $USD by themselves. Looking at the Euro...

The 1 min Euro (futures) is negative, this would give the $USD some near term strength as we have already demonstrated with both the USD short term and Yen short term charts, both arguing for a near term move higher in USD/JPY and thus the market, the Euro looking like this only helps NEAR TERM.

However at 5 min the Euro is leading positive, this would have the opposite effect and weaken the $USD which we already see on the $USDX 5 min chart, again suggesting any USD/JPY led bounce is very brief, also suggesting some near term EUR/USD upside AFTER a market/USD/JPY bounce in the VERY near term.

The Euro's 15 min chart is also building positive so it may lend even more strength to a EUR/USD bounce and sap more from the $USD and thus the $USD/JPY and the market again, after a very near term, very short term bounce.

I don't see anything very exciting in the traditional levers, we know that VIX short term futures and spot VIX underperformed their correlation vs the SPX today and the VXX has some negative divergences in it, TLT near term does nit, mid term it does, but that's another subject. I was surprised not to see stronger positive divergences in the main ramping lever, HYG.

VXX near term 3 min chart with a negative divegrence suggests a near term pullback and a bounce in the market, but note the size of the current negative next to the larger positive, there's more gas in the tank on that positive so I view this as a near term/short term event (VXX pullback/market bounce).

The 60 min VXX chart is about as strong as ever, clearly hinting at the big picture market movement being to the downside/

As for HYG, it couldn't even hold together a 1 min positive today. There is a 3 min positive, but only through the last half of today, unless they intend on strengthening the base, which doesn't seem likely based on the currencies above, I suspect there was little appetite to take on HYG risk even as a ramping lever short term.

I did however find some HY Credit leading the market today, as I said earlier, about half to 2/3rds of the HY assets I watch, so that makes me think a bounce is very probable, but with everything else, not long lasting and I mean perhaps a day (I'll know more when I see if they continue to build it tomorrow or just bounce it tomorrow, the latter would point to a shorter term move, I'd still use it to sell in to as I demonstrated today with Biotechs...Letting the Trade Come to You- NASDAQ Biotechs

In most other cases, Leading indicators added nothing today beyond what they added late last week, leaving many still in a short term positive position for the market, but not much else.

Finally, I would expect breadth to signal a severely oversold market (near term- as in 1-2 day oversold)... And that's what I found.

The Dominant Price/Volume Relationship was extremely dominant with 27 of the Dow 30, 93 of the NDX 100, 1042 of the R2K and 412 of the SPX-500, the relationship was close down / volume up, this is a strong 1-day oversold condition and typically the market closes green the next day on the oversold condition. This is one of the strongest Dominant P/V relationships we have seen in some time.

Of the 9 S&P sectors, 9 of 9 were red with Energy lagging at -4.14 and Healthcare leading at -.51%.

Of the 238 Morningstar groups, only 44 of 238 closed green. ALL 3 OF THESE SHOW A MASSIVELY SHORT TERM OVERSOLD MARKET PRIMED FOR AN OVERSOLD BOUNCE.

Taken with the currencies and 3C charts, I'd say is pretty much inevitable unless some fundamental news blows things out of the water, however I still WOULD NOT chase this, but let the trades come to you and trade with the probabilities (short).

That's the take-away which has been the same all day, the additional currency information gives some more color. I'll check on futures later and post anything out of the norm, but I think we are on course for some trades to come to us and I know a lot of you are hoping to get that opportunity, just remember that bounces are made to look credible so while you may feel that way now, you may not feel the same way after seeing the bounce, just remember the highest probability charts and all of the pieces of the puzzle we've gathered. I'll be looking for specific opportunities in to any bounce and will post them as I find them. Other than that, have a great night!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment