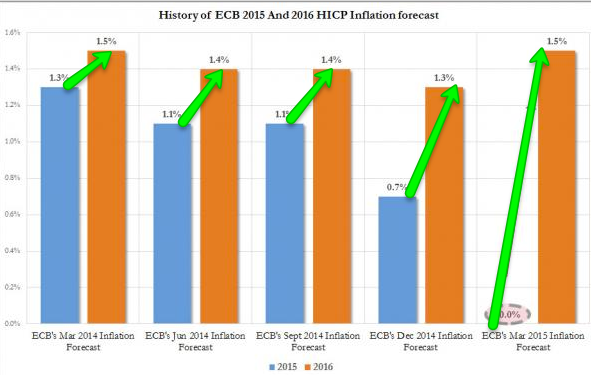

What I don't understand and it's not all that important that I do as I'm not privy to insider information, is why gold would be an asset that would gain in value when all indications are generally pointing toward deflation or at least the perception or fear of deflation except in Mr. Draghi's case who forecasts inflation to go from 0% in 2015 to what they call a "Hockey Stick" save or recovery and print 1.5% in 2016, to give you an idea of what that would look like...

That's a pretty wild ride isn't it?

OK, so maybe Draghi knows someone in OPEC and knows exactly what they are going to do as the downward revisions to ZERO have been blamed on cheap oil, to me it seems like one of the wildest, unsubstantiated guesses a person in that position could possibly make.

However, the market is about perception right? It's just the perception about Mr. Draghi is not exactly one of trust and commitment.

The reason I mention this is that usually gold is bought on the EXPECTATION of inflation and with central banks mostly coming out on the side of, "Near term we expect more deflationary pressures" (not suggesting outright deflation, but the lowering of inflation expectations; the F_E_D has done it, the ECB certainly has done it.

We know that the F_E_D needs some excuse to say they expect inflation to move toward their long term goal of 2% so to get done what I think they need to get done, inflation has to start to ramp up so maybe Draghi and the F_E_D know something that we don't whether it's real or subterfuge.

Or perhaps there's something else to it.

In any case, I just follow the charts.

This is the chart showing some accumulation to the left ad a rally off that in to a negative divergence which is the area in which we called for a gold pullback which has happened since.

You might be very tempted by the 30 min leading positive divergence since the pullback has gone lateral (typical base building or a reversal process), but I'd probably let this play out a bit longer,

Take a look at price inside the white box, does it not look like the common "W" bottom could form with a slightly deeper pullback to the recent former lows inside the box? To me it does, which may also see a head fake move below defined support by the time such a price pattern were in place. Assuming that were the direction GLD was moving in, I'd want to be long on the head fake below the support level of the "W" pattern, not only for the better entry and lower risk, but for the excellent riming cue head fake moves give.

On a 10 min chart with more detail ( a bit more noisy), we have the exact same trends, positive in to a rally and a negative divergence in to a pullback which is seeing positive 3C activity as price has transitioned from down to lateral. In cycle terms that would be a stage 4 transition to stage 1 base within a sub-intermediate to short term trend.

The 5 min chart shows near perfect downside confirmation on the pullback after the negative divegrence and a clear positive divegrence since price started moving sideways.

On a 2 min chart close up, you can see the near perfect downtrend confirmation by 3C with each little upside pop shot down.

This is the same chart zoomed out. Again, the same trends are evident from accumulation to distribution to pullback, but here we don't have the accumulation of the longer charts, that's because the longer charts represent what I would call the strategic outlook.

When the short term charts start going positive, they are showing us timing or what I'd call the tactical outlook , the area and time we'd consider an entry, so I don't think we are there yet for more than 1 reason, but I think we are going there.

I did take a quick look at Gold futures (YG) and I see confirmation. This 10 min chart shows the same downside confirmation that the GLD 3C charts show.

This longer 30 min chart shows the same continues pull back and in line status, at least until there's more work donee in the area and stronger signals, I'd be patient, but I do think we'll have an interesting trade to consider soon.

No comments:

Post a Comment