""Internals...

Ironically in almost perfect opposition to Friday's oversold condition in P/V relationships and sector performance, today was near the EXACT opposite.

The Dominant Price/Volume Relationship once again hit extremes in all 4 major averages, but unlike Friday's solidly near term (1-day) oversold, today was the most bearish of the 4 relationships, Price Up /Volume Down. There were 21 Dow stocks, 82 of the NDX 100! 1018 of the Russell 2000 and a walloping 316 of the SPX 500 (of 4 possible relationships), this is extremely dominant.

While I'd normally say this is a 1-day overbought condition, it can also be interpreted as a VERY weak upside move that is failing, we still have that SPX trendline head fake area just above around $2115 which would make for an excellent set of trade set ups as mentioned in Friday's Daily Wrap, especially put positions."

The red part obviously being the point of the entire data series. Although there's a ton of things to look at and post on, the general thrust of the last paragraph seems to be right on track.

The VIX (/VX) actual futures, rarely post divergences beyond a 1 to 5 minute chart for whatever reason (this is not the same as VXX-Short term VIX futures), but today, they are positing positive divergences in some very strong timeframes suggesting some very deep pockets are hedging or buying outright protection. It will be interesting to see if the SKEW Index (Black Swan Index) sees a rise tonight.

Usually I don't see much beyond this point.

Here are the 7 min VX futures positive as well with a lot of action coming today alone which fits the Internals post from the Daily Wrap, that any additional gains in the market would be in a very weak, unhealthy environment.

I was surprised to see a leading positive 10 min VX chart

15 min as well...

And even a 30 min leading positive divergence. Even the 60 min chart shows signs of a positive divegrence.

This is rapidly forming, meaning it's not retail over a longer period as it would take quite a while to hit some of these longer term charts, even at 5 and 7 min, but 30 and 60 min positives in a day is big money changing hands and VIX is a Flight to Protection trade.

As for the highest probability resolution, we have known that since before the move higher off the April 2nd forecast (triangle-based breakouts such as AAPL yesterday).

Since the move forecasted on April 2nd, this is the 60 min ES chart which is confirming what we already knew as the highest probability before any real upside move started.

ES 60 min shows the positive divgerence that was "part" of the analysis that went in to the April 2nd bounce/triangle-based volatility breakout which was fully expected to see distribution, fail and make a lower move like the $USDX which was also forecast to bounce, then make a larger move to the downside, perhaps changing the primary trend in the $USD which has all kinds of implications from carry trade to F_E_D interest rate hikes sooner than later and not least of all, its leading nature vs the SPX recently.In any case, the 60 min Es/SPC futures confirmed what we expected to see in to any move higher, DISTRIBUTION.

That was based on the highest probability forecast of the ES daily chart which as you can see has been in a leading negative divergence for all of 2015. You think the Q4 2014 S_E_C filings showed strong distribution among leading fund managers, wait until the Q1 2015 filings come out (45 days after the end of the qtr. which was March 31st).

Remember one of 3 things I've been looking for is the 7-10-and 15 min charts to go negative in Index futures.

This 5 min ES chart confirms what was posted yesterday/last night in the Daily Wrap with regard to internals posted above from last night's post. Note diminishing volume and a deepening negative 5 min ES/SPX futures negative divergence.

As for the 7-15 min. timeframes, each average is a bit different, but overall we are largely there, I'd still like to wait for a line up of all on every timeframe screaming, but with VIX futures looking like this, we are so close it's hard not to be a little edgy. Also remember our analysis and forecast/expectations for Spot VIX which is winding up a coil of strength on a Crazy Ivan shakeout with its triangle's apex just nearby and the 50-day just above (VIX trades opposite the market).

As for those charts which were 1 of 3 conditions I've been looking for...

TF/Russell 2000 7 min leading negative

TF/Russell 2000 10 min leading negative and again note the distribution since yesterday's forecast oversold bounce from Friday's oversold internal condition.

NQ/NASDAQ 100 Futures 15 min charts. leading negative in to last week and Friday's decline which produced a 1-day oversold condition with the bounce yesterday seeing even WORSE distribution in to the move on a significant timeframe.

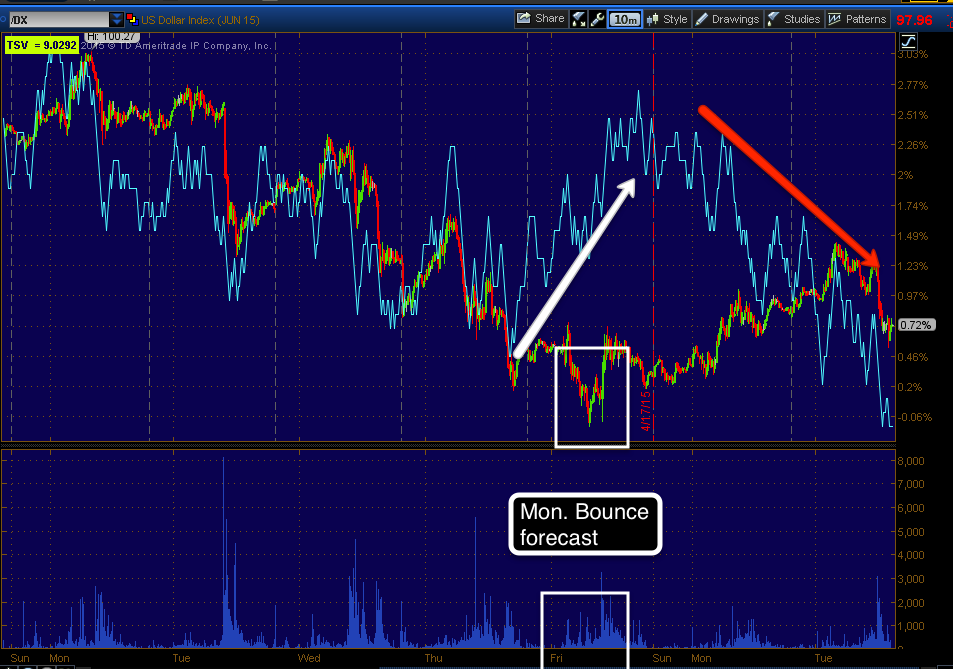

As for the $USDX and it's position/forecast, although I think there's still some room for consolidate noise within the larger downtrend forecast after the initial bounce (from 4/2 forecast), I believe it moves lower ultimately and that has consequences on a great many things from carry trades to the F_E_D feeling better about hiking sooner to the leading indication the $USD has provided for the general market as well as the primary trend on a daily chart of the $USD negative and the Yen leading positive, the conditions I laid down nearly 2 years ago for a primary downtrend/bear market.

Note for the first time in the $USD's trend of the last year + this is the first break not making a higher high, I anticipate a high probability that we see it make a lower low as well, ending the primary uptrend and starting something new within a downtrend, just as expected for the primary trend for the market (USD down/Yen up).

Here's Friday's leading $USD signal for a Monday market based/breadth based oversold 1-day condition and bounce expected Monday (yesterday) and the short term nature of the $USD support and the overall market support (weakness in the area) as there's a negative divegrence in to yesterday's $USD move higher after the biggest 4-day move down in a year in the $USDX from last week.

The point being, we have exceptional weakness in the area and it's hard to stay patient here looking for the best pivot to keep us out of meat grinder chop and entering at the best time we can find in the best assets. I just thought you should know about the condition of the market, the $USD's role and protection being seriously bid.

No comments:

Post a Comment