The "weakness" I am looking for since late last week's forecast for early this week, still hasn't materialized to any great degree, but all of the signals are still pointing that way and are intensifying so I fully expect we will see that weakness. It seems we saw some early stop run activity this morning. The kind of weakness I'm looking for should at least fill the recent gap (up) in the major averages if not some...

Here's a quick update of near term intraday activity....

NYSE TICK Index activity has been trending down all morning, but it is starting to reach downside extreme levels -1250, etc. so intraday breadth (selling) is getting stronger.

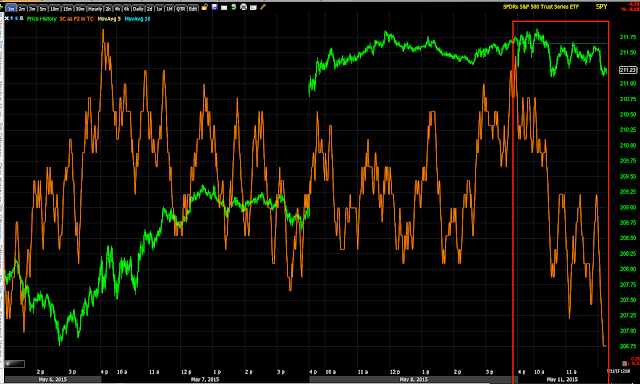

Again this SPY 3C chart is one of several charts that told me late last week that probabilities were for weakness early this week in the averages. Note there has been no improvement (2 min).

The intraday SPY 1 min chart has seen significant deterioration today (in the red box) and is leading negative so I expect downside momentum to pick up shortly.

The IWM which has been the outperformed today also has the same 2 min negative like the other averages, it may have better relative performance, but I still expect it to lose ground as well.

The 1 min intraday IWM chart deteriorating as well today, not as bad as the SPY above.

As for our short term VIX calls trade idea, I fully expect they'll be doing well as the market comes down...

This 3 min chart confirms the near term signals of the charts above from late last week on the short term timeframes as this is leading positive (VIX trades opposite the market generally speaking).

And the intraday trade on the VXX 1 min is maintaining "in line" or confirmation status so it looks like it is just waiting to move higher with nothing telling me at this point any thing contrary.

There are a few assets I'm watching for potential trades, NFLX seems rather parabolic, it may be worth a put position for a quick trade if we get some decent signals that it is a parabolic move and one about to fail. Initial signs are building now...

NFLX 1 min intraday today as price has stalled sideways and seeing a negative divergence on today's move starting (1 min).

As far as what I'm looking for next other than potential trades like NFLX above, really it will be more about trade management (VXX calls) or some of you have puts on the averages rather than VXX calls. After that, we'll have to see what the underlying trade looks like in to a market decline and if it's worth playing any very short term trades or whether we are best off staying focussed on the larger picture (major market weakness). As I have said, I suspect we will see the market try to put in a wider base as last week's "V" base was almost certain to fail, after that it should try to bounce as the "rates lower for longer" theme builds steam , today with F_E_D data suggesting employment weakness. Oddly though these signals were in place before the NFP or today's F_E_D data...Leaks?

I can't say for sure, but either way, I believe the F_E_D is still on track and very much wanting to normalize policy, they'll just have a harder time justifying it now which is why they introduced all of the subjective language like "If we feel comfortable inflation will move toward the long term...", despite what the actual data is saying. We picked up on these changes the same day QE3 was announced and they have just continued to build on this arbitrary view of macro data so they can tighten policy despite macro data.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment