Yesterday I posted Market Averages- Charts that matter and in that this chart...

This was an example of looking back at historical charts to gain perspective and anchor expectations. The point was that during this financial crisis we had a 2 month rally that had many people believing the worst was behind us, but even more insidious was the downtrend that followed with 41 days, 21 down days and 20 up days. I guess you could say that my point was, "When you are living on the right edge of the chart and don't know what comes next, you can miss an entire trend because you are too focussed on intraday or day to day trade", like the fact that almost every other day above during a downtrend, there was an up day to cast doubt on that trend.

The only way the market ever makes it easy or clear is in hindsight or retrospect, that's the market's job, to make as many people as possible wrong at any one time.

In any case, this morning we start with a nasty overnight session and some strong opening trade, this is why I often say, "Let the morning trade burn off", it's often filled with manipulation, misdirection and moves that are just there to snatch overnight or pre-market orders from those that have a 9-5.

Here's what we have this morning...

Single Currency Futures...Euro

The 5 min 3C chart of the Euro doesn't look good as you can see, a leading negative 3C divergence sent the Euro lower which doesn't help the EUR/JPY cross which doesn't help the market.

The other side of the carry crosses is the JPY, if it moves up, then it pressures the carry trades down, but if this near term (15 min chart) slight negative sends the Yen lower, even briefly, it will benefit the carry trades of which there are about 3 very active ones.

The Carry Trades vs. ES (SPX E-mini futures). ES/SPX futures are purple, the carry cross are the candlesticks.

The EUR/JPY doesn't look very good and you saw the Euro above, maybe there's a dead cat bounce there, but otherwise, for now it doesn't look like the market will get much help for upside support here.

This is the USD/JPY vs ES and as I said earlier, the $USD's longer term charts look like it has more upside, but near term are very fuzzy so it's a tough call, even the Yen chart is a bit fuzzy and a tough call, but the trend in the carry is down as with the one above.

Finally the AUD/JPY, ES looks like it has been following this one closely.

So what other mechanisms are there? The SPY (Market Arbitrage) which is TLT down, VXX down and HYG up. There are some signals showing that is trying to be activated, how long it can last is any one's guess, HYG was under accumulation several days ago and that completely failed before it could help the market.

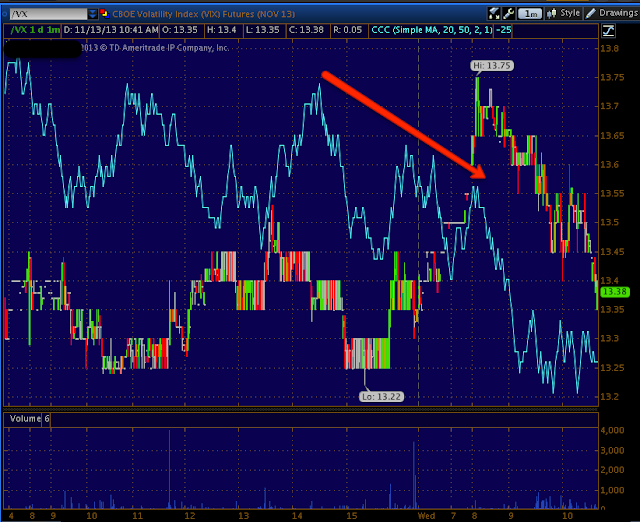

This is the VIX futures 1 min intraday with a negative intraday just before the open sending VIX futures down, which is part of the SPY Arbitrage set up that can support the market.

UVXY as a proxy for VXX with an overall positive divegrence which is not good for the market, but intraday a relative negative that should and has sent VXX lower (VIX), this is essential to the Arbitrage activation. However, keep your eye on the larger trend on the chart too, a stronger leading positive, the market jiggles all the time so this is showing a larger negative force on the market with nearby help for the market intraday.

HYG is the second of the 3 assets and it needs to move up (HY Credit), again there's a small intraday positive divegrence that can help the market intraday, but the larger trend here is a large leading negative divegrence which is not helpful to the market, so although it's difficult, you have to keep multiple timeframe analysis trends in their proper perspective.

If the market were to see some strength, and it's early to say that because of a.m. trade, but if it did see 1 day or intraday, that's the kind of help PCLN needs with it's triangle, so not everything that seems good or bad is actually as it seems.

As you probably already saw, PCLN broke out of the triangle, I doubt it would have had support to do that without the market going for the gap fill this a.m.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment