Some think it's the Dubai bear market losing another -8% overnight, some think it's the German Zew coming in at a miss, I doubt either helps, but a one sentence soundbite can't sum up the market's numerous dynamics.

In any case, the result since yesterday's 4 p.m. close in S&P futures looks like this overnight...

Since the 4 pm close (16:00) to the far left, this is S&P futures overnight, selling off to the low of the week around 5 a.m. this morning.

On the week...

The yellow arrow is yesterday's close, the red dashed line is Futures activity since they opened this week, a series of lower highs and lower lows thus far.

And S&P futures since last Wednesday's FOMC, apparent "knee jerk reaction", as it was a knee jerk with absolutely no follow through. The current 15 min chart looks a lot like a reversal process of that knee jerk.

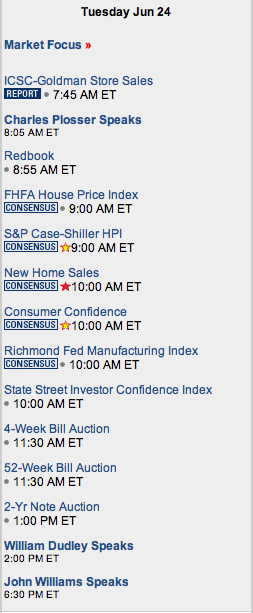

Today we have noted voting F_E_D Hawk, Charles Plosser speaking right now (8:05 scheduled) and at 6:30 pm, voting Dove, John Williams speaks.

As far as the rest of today's market focus....

I am really liking the way SQQQ and FAZ are looking, I'd like to see XLF take out nearby resistance as it's so close and look at a FAZ new entry/add-to there, however with the SKEW Index rising as out of the money options are bid, we may see a faster moving market than expected. I can't help but wonder if the F_E_D's virtual silence as far a anything new was a real problem in the face of a growing inflationary trend, as this is one thing that will force the F_E_D's hand to end accommodative policy and hike rates which has in the past, not been taking well by the market.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment