Yesterday I decided to close half the NUGT position, more or less take the gains off the table and then some on what I believe will be a pullback to the 10-day moving average or thereabouts as well as a gap right in that area. Thus far I see no problem sticking with that decision, if it looked more like a larger pullback, I'd consider playing the pullback with DUST (3x short miners), however this looks like a true overbought correction which is ultimately healthy for at least GDX/NUGT which appear to once again be leading gold after years of that correlation being dead under the QE regime.

Thus far today...Gold Futures...

This 15 min relative negative on the gold futures chart doesn't look like anything more serious than a constructive pullback...

The same for the 5 min gold chart which looks very timely, thus closing half the NUGT position yesterday feels like the right thing to have done, while leaving something on in case of a surprise as the charts that matter that have taken GDX/NUGT nearly vertical, remain very strong.

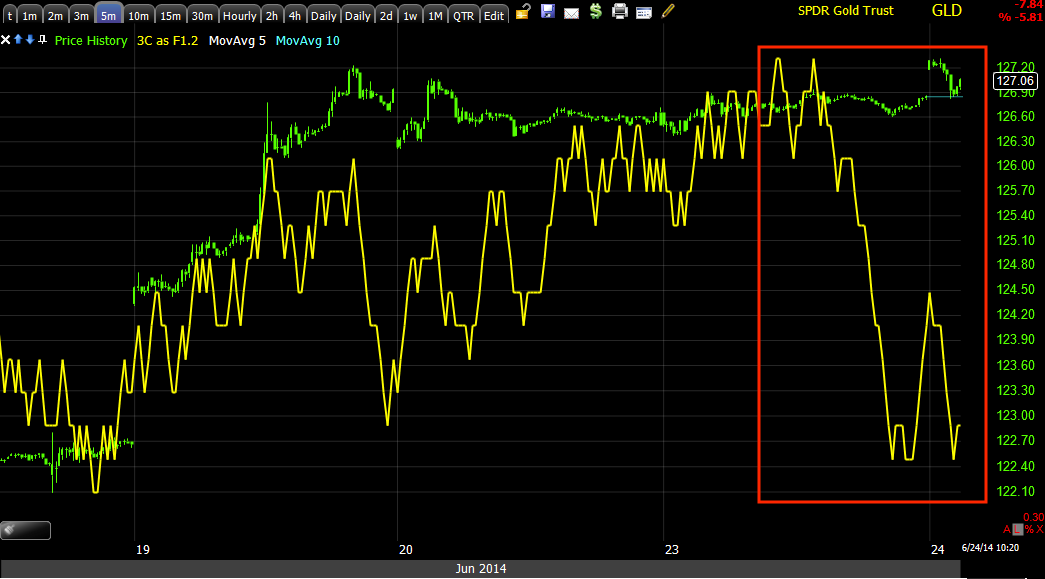

GLD charts...

Again the timing of the NUGT position management looks to be right on as this 5 min GLD chart shows a fast, but still pretty small 5 min leading negative develop quite quickly. Thus far this morning, gold has lost its gap up.

The 2 min chart...

And the 1 min chart looking like near perfect timing.

As far as the bigger picture, this is an example of not only the leading positive 60 min chart, but the near vertical move in gold and miners with miners outperforming.

GLD 60 min.

I suspect GDX/NUGT and GLD are all going to behave in similar fashion...

Thus a GLD pullback, even though it gave a long signal a few days after GDX, will probably see it pullback somewhere around the yellow 10-day average, which is where there's a gap as well and the market has been ruthless the last several years about filling gaps.

NUGT...

Yesterday I took some action here, Trade Management: GDX / NUGT which looks like we may have saved a few percent as it looks like the Trend Channel stop is going to be pretty close to being hit...

60 min Trend Channel has held this entire trend on a closing basis, if it's possible to get out at a better price as the TC will never take you out at the top, then I will go with that if there's good reason which even the Trend Channel seems to be showing there is as the increased ROC of price often precedes a change in character that can include a pullback.

The stop on a closing basis is now at $44, for now I intend to still keep half the position open unless the charts deteriorate beyond looking like a constructive pullback, I just wanted to book the gains and free up the capital for other possibilities.

NUGT 30 min, a very strong base, but as it has made a 66% move over the last month, profit taking and consolidation are inevitable.

The 15 min chart with a relative negative, if this were leading negative I'd likely have taken the entire position off until the pullback ends.

And timing, the 5 min is giving a fairly strong timing signal taken with GDX and GLD. I expect a pullback around the area of $38.50 or so, I'll be setting alerts (price) for the area to look at adding the half size position back at a better price, allowing me to have kept a fair portion of those gains and do it all again.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment