Earlier in this morning's, A.M. Update I had mentioned that most of the overnight action was in currencies, especially the GBP/USD on the news of a poll that most voters would vote for the upcoming (Sept. 18th) Scottish independence referendum. There has been weakness in that pair, the EUR/USD and in the Yen (The Sterling, Yen and Euro have all been weak ), this has sent the USD/JPY up and the $USD/JPY up.

Looking at this chart,

you might think this is some sort of divergence indicator, this is the dislocation of ES / SPX Futures (purple) from the USD/JPY which it has tracked nearly tick for tick for years as a Carry Trade.

*Note the USD/JPY just hit 5 year highs, running orders/stops at $106.

You may recall recent musings on the site as to whether the end of US QE is going to revert the $USD back to its historical Legacy Arbitrage relationship which has been completely skewed due to the F_E_D and carry trades over the last several years, instead of running from $USD strength, they've been following it, but the last few weeks there has been some question as to whether this historical correlation between the $SD and nearly all $USD denominated assets like gold, silver, oil and even stocks was once again returning back to the historical inversion.

While a few days/weeks is hard to call a trend after years of another trend, the timing does make sense with F_E_D QE coming to an end and some of the other sovereign issues in each of the countries mentioned above.

Here are some other correlations... *These charts show the $USD in purple and the comparison asset in candlesticks*

$USDX vs ES/SPX futures on a 1 min chart, the correlation is just like the historical Legacy Arbitrage $USD correlation in which stocks, most commodities like gold, silver and oil move opposite the $USD.

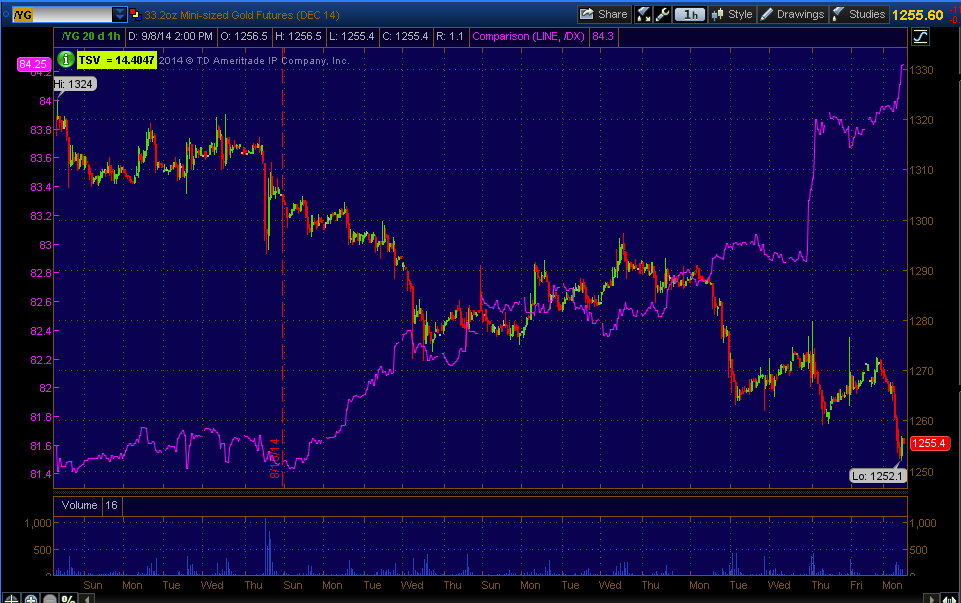

This 60 min chart of $USDX (purple) is against gold futures, it does seem that there has been a recent pick up of the historical correlation. I can't find any other good 3C reason beyond the pullback we expected about 2 months ago in gold and gold miners, this does seem to suggest that the $USDX correlation is at least exacerbating the situation.

This is the $USDX (purple) vs Brent Crude Futures intraday.

And $USDX vs Silver futures (10 min).

Even Treasury futures are moving opposite the $USDX and down...

And the $USDX which seems to be gaining strength on a weak Sterling (GBP)...

As well as weakness in the Euro

And the Yen...

If this historical legacy arbitrage sticks, there's another very large multi-year change in character.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment