UUP 1 min this morning is inline with price.

While it may be a little early, I'd expect to see more of a reaction from the 5 min chart, it hasn't confirmed price and doesn't look to be trying very hard.

The 10 min chart is actually negative (again it may be too early to be looking for a response from the 10 min chart as we only have 10 period of look back (on a 10 min chart) so far and this version of 3C is best suited to 30 periods.

Remember the $1.40 level being the significant level for the Euro, we saw an earlier break, and a recovery, this may be a shakeout, I do expect this level to break, but as we see every day, clean breaks without volatility around these important price levels are few and very far in between.

Here's GLD, 1 min is in lock step with price, not giving us any significant information yet.

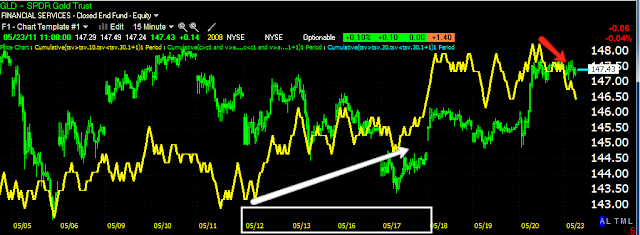

The 5 min chart shows an accumulative period and right now a failure to confirm. Again, this is pretty early to be looking for divergences beyond a 1 min chart, but if there's a strong enough move, it will materialize on these charts this early.

The 10 min chart seems to indicate some selling here.

On the 15 min chart you can see the accumulation period was actually about 4 days, that should provide more upside for GLD normally. We are just starting to see a small negative divergence on the 15 min chart, this is where divergences really mean something. However, keep in mind that distribution or the start of it doesn't = reversal. They distribute into higher prices, it gives us an idea of what's going on and ultimately will help with the timing, but I'm not sure I would write Gold's move up off yet.

Interestingly, a stronger dollar, at least in the Dollar index (which is 50% weighted against the Euro) seems to be in the card in the near future (beyond what we see today), however, we are also in an inflationary environment, despite what the Fed think of it (transitory) and historically gold has been the natural hedge against inflation. We are seeing a lot of central banks take delivery of physical gold, so we have two opposing themes working here, that of the inverse dollar correlation and that of an inflationary hedge. I would think one is going to have to give, it may be a matter of looking at two different trades happening at the same time and trying to analyze this as a single directional trade.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment