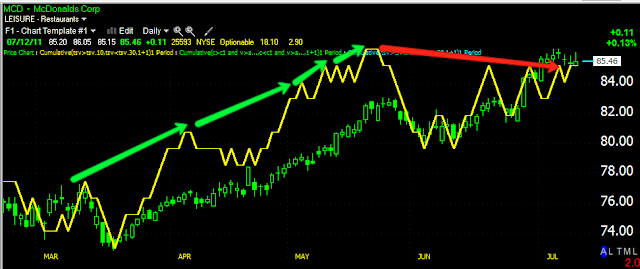

MCD just completed a parabolic move up, there haven't been too many and they typically end with a pullback. Whether this will end up in a pullback or something worse is too early to know.

Looking at the recent parabolic move, there are several noise candles in orange recently, this helps us define a trend, but nose candles also almost always show up before a trend reversal which could include a pullback or again, something worse.

Daily 3C from confirmation to negative divergence

Hourly 3C

The uptrend cycle with accumulation and distribution visible on a 30 min chart.

Recent highs went negative on the 10 min chart.

Today's highs went negative on a 1 min chart-note the highs of the day were tested and that's where the divergence occurred.

The Trend Channel. A move below the $84 area should be taken seriously. A break of the TC could simply lead to a pullback, but the market is a lot different now then t has been the last 2 years, so we must be cautious if we try to buy a pullback in MCD.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment