Treasuries paint an interesting picture....

If you read my post last night on the direction I thought the market would be taking, including being down today, then you may find these two Treasury ETFs interesting as they more or less fit with the observations from last night. Understand that I'm not a bull or trying to make a bullish case, I'm a realist who happens to see the longer term picture in a very bleak light, but I've lost a lot of respect for a certain web-site that I have whole-heartedly agreed with in the past, however their Perma-Bear attitude I find distasteful and when the market was up yesterday, their whining about it I thought was out of line. I want to inform my members and when the market is bullish, I'm not going to whine about it because I have a long term outlook that differs. I want to bring you the market as it is without biases and prejudices, bullish or bearish.

Here's last night's post which picked up on several of the themes from yesterday, if you haven't read it already, I would suggest you do, then this post will make more sense.

We know that one of the safe haven trades can be found in Treasuries, so I look at, compare and contrast two long term Treasury ETFs, 1 a bullish 20+ year, the second a bearish 20+ year and find some interesting parallels with the market and what has thus far been my opinion on the market moving forward.

Lets start with the Bullish Treasury that is a flight to safety trade when the market is down, TLT. We'll start with the longer term charts, that have more importance when it comes to the bigger picture and end with the short term charts which show imminent moves, but do not necessarily have much to do with the big picture, but more to do with what is right in front of us today or over the next few days.

TLT 20+ Year Treasury Bond Fund-the Safe Haven Trade (click on the chart to enlarge)

TLT 60 min shows what appears to be a trend reversal with a negative divergence at a top and the recent leading negative divergence as it approaches stage 4 -decline. This is not a healthy long term chart in any way.

TLT 30 min, this too shows the same exact thing, from the top to the leading negative divergence in the red box.

TLT 15 min, there was some earlier confirmation at the green arrow, yesterday we saw some late day accumulation by way of a leading positive divergence, but so far this morning's action is NOT confirmed, and at a negative divergence on the move higher in price.

The 5 min chart shows some accumulation several days ago and some slight accumulation in the morning yesterday, but that could also be attributed to 3C simply heading down and not moving fast enough to catch up with the gap down yesterday on the market's strength. Currently today's action is NOT confirmed, but rather in a position of a negative divergence.

The 1 min chart showed nothing yesterday, no real divergence at all-this is backed up to yesterday's close.

Forward the 1 min chart today and you'll see again that between two relative points, the first much lower in price and the higher price today, 3C is still in a negative divergence. The main point being there hasn't been a lot or much at all in the way of underlying strength building in to this move higher on a flight to safety and the longer term shows a bleak outlook for the safe haven trade. This fits well with my analysis and my developing opinion on where the market is heading.

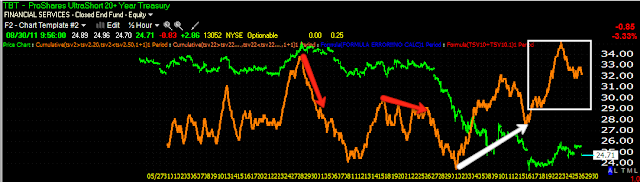

Now... TBT UltraShort the 20 year Treasury. This is the opposite of the safe haven trade and should move up when the market moves up and vice-versa.

While we've seen weakness in the past months, August has shown a long term 60 min positive divergence, just like the major averages and many of the man industry groups. In fact, we even have a positive leading divergence here.

The 30 min chart is similar with another current leading positive divergence-remember that leading divergences are the strongest and you can see why they are called leading as price is near the lows on this chart, while 3C is near or at the highs of this chart, even compared to when price was much hgher in months past.

The 15 min chart also has a leading positive divergence.

The 10 min chart, much like many of the averages I showed you, shows a negative divergence, I believe this is what sent the markets lower today as the 10 min timeframe was a common theme last night for the negative divergences in the market.

If I back up the 5 min chart until yesterday's close, you can see the 5 min positive divergence. toward the end of the day, we saw much the same n the major averages yesterday.

Roll the 5 min chart forward to today and even the drop is still in a positive divergence thus far, although it s still early.

Here's the 1 min chart rolled back to yesterday-note the positive divergence and remember what I said last night about any negative divergences in the market yesterday were getting steam rolled, but they accrued on the 10-15 min charts.

Roll the 1 min forward to today and even with the drop, it's still, thus far in positive territory.

If you read and understood last night's post, then this post should compliment the findings from last night's and many of yesterdays with respect to my market outlook.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment