So I always schedule my appointments as early as possible, I had an 8:45 appointment today, and planned on being home by 9:15, however my back doctor fired all of his staff that have been there for years and the new people have no idea what they are doing. I didn't even get in to the exam room until 10:30 so I missed the market open, luckily this is only 1x a month or so. However, I got some great emails from members using 3C that took the opening signal to take profits, a couple bought back toward the end of the day. One of my long term members that I just adore put it this way, "Good news, I got out of my UPRO at $51.21 and made some good diaper money. I could hug you. Now adding back some UPRO. " That's all her and I think it's awesome!

So here were some early 3C signals, all 1 min negative divergences, which is a timeframe that effects intraday moves, unless it is in a running divergence, then it is indicating accumulation which migrates to the 5, 10, 15, etc. min charts if it is strong enough. Often we can see both.

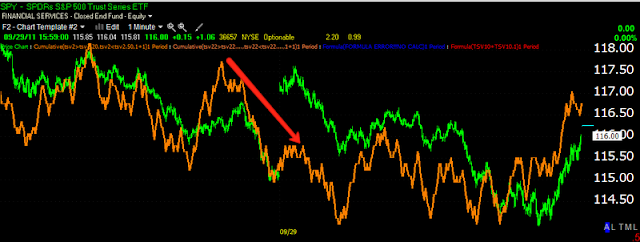

Here are the opening divergences that some member's using 3C used to make some extra trading money, of course this type of day trading isn't right for everyone.

DIA 1 min negative-suggesting a pullback/downside

IWM 1 min, also negative

QQQ, negative

SPY, all negative 1 min charts on the open. It's best to have multiple index confirmation like this to trade this signal.

I'll cover the multiple timeframe signals later in the daily wrap post, but suffice it to say, I'm very happy with the way they have developed.

With this round of accumulation more then any other, I have suspected there would be a longer period of accumulation simply because the depth chart was so strong, yet we didn't get as many days of accumulation as past moves. I have noted this since the accumulation period around 9/23-9/26 and several times since then.

I mentioned it last night in this post with the following chart and excerpt...

"There's still a possibility we see a scenario like this with initial accumulation, a rally followed by more accumulation and a larger move up. We'll have to see whether accumulation picks up enough to send the market higher or whether distribution continues in to the pullback."

This scenario embodies the spirit of the idea, but it doesn't look to be the most likely outcome.

Last night in the same post linked above I showed the pullback in an August uptrend as a normal part of the uptrend, but I looked at all of the charts for that timeframe and none showed accumulation in to the pullback, it was just a pullback, so this seems to be what I expected in that we would add more accumulation, but in a different way then the examples shown. Thus far we haven't seen the above scenario with a second round of accumulation displayed in the chart above and it is different then the August pullback as that did not add accumulation. In tonight's Daily Wrap, I'm going to elaborate on this, show you the charts, many of which you have seen today as they developed and I'm going to address a possibility for the longer term uptrend that I have been talking about for about a month now. Some information came out today that ironically fit in to one of the examples of a catalyst for the extended move up that I had offered half seriously. It's actually quite interesting. I'm also going to show you just how far ahead of the information curve Wall Street really is and how rigged the game really is.

As my options master member who is doing exceptionally well said in his email to me about his 200+% gain since following 3C signals in August,

"Of the two main trading accounts I use, one was 252% and the other was 97.4%. There is NO way this kind of performance could be possible were it not for 3C's predictive ability coupled with your analysis so I don't take any credit other than trying my best to keep emotion out of the trades, staying the course and deciding what to do with your analytical insights. I hope it helps convince people that market timing is the ONLY way to go and makes them true WOW believers."

My friend is being a bit too modest, I agree of course that having insight as to the underlying action, which almost always contradicts price action, is absolutely the way to go. The point of Technical Analysis is to see what smart money is doing and follow along, unfortunately it simply doesn't work like it used to just 10 years ago.

MarketFolly.com during 2010, a year in which making money was very easy, the top portfolio managers including: John Paulson, Ray Dalio, Jim Simon, Israel Englander, David Einhorn, Steven Cohen of SAC, Bill Ackman, Paul Tudor Jones, David Tepper, Phil Falcone, Larry Robbins, Louis Bacon, Dan Loeb, Cliff Asness, Barry Rosenstein, John Burbank, John Arnold, Whitney Tilson, Richard Perry and other top fund managers; averaged 18% for the entire year. The best performing fund was Louis Bacon's Moore Capital, which had very mixed performance with the flagship fund only up 3%, which was severe under performance as the S&P returned 11% for 2010, however his Micro Manager's Fund returned 105%. Jim Simmon's legendary hedge fund, Renaissance Technologies (Medallion Fund) returned 30%. And what would you have to pay as an investor in his fund? a staggering 5% management fee and an unreal 44% in performance fees! So our option trader blew them all away in a single month and didn't have to give half of his gains to a manager.

The WOWS Equity Only Model Portfolio has so far gained 89.31% for September.

The monthly ranking is now 1/100th of 1%. The median return for the month, which includes traders from Motley Fool as well as universities such as MIT and the Wharton School of Business is -1.04%

And the 4 day old WOWS Options Model Portfolio has a return of 17.15% and is already ranked in the top 6/10ths of 1% for the week thus far.

This isn't luck, it isn't good guesses, it isn't that I have an MBA from Wharton, it's quite simply thinking outside of the box and having found a way to time the market and not only beat the market, but beat hedge fund managers like David Tepper who made $4 BILLION Dollars in 2009!

And you know why Chris was able to make 252% (it's even more now), because he simply took information and applied it to his trading which he spent many years developing. I learned a lot from Chris about trading options and hope to do even 1/4 of what he did this month. However, his results are his achievement.

Please don't make comparisons to where you are vs. the model portfolio or anyone else's performance. As I posted the other day, Zen and the Art of Investing, trading is a unique journey for each of us, just like the spiritual journey I believe trading actually is. Everyone has their own path and no two paths are alike. There's no better or worse in the path you chose. The entire idea behind the model portfolio was to show members they could take updates and information and use them to trade from. It's turned more in to a diary of what I am doing, which is fine, but that wasn't the intention. Follow your path and as long as you are beating the market, making and/or saving money, and enjoying the process, then you have found success.

Please don't make comparisons to where you are vs. the model portfolio or anyone else's performance. As I posted the other day, Zen and the Art of Investing, trading is a unique journey for each of us, just like the spiritual journey I believe trading actually is. Everyone has their own path and no two paths are alike. There's no better or worse in the path you chose. The entire idea behind the model portfolio was to show members they could take updates and information and use them to trade from. It's turned more in to a diary of what I am doing, which is fine, but that wasn't the intention. Follow your path and as long as you are beating the market, making and/or saving money, and enjoying the process, then you have found success.

My advice for beating the market, stop thinking like the sheep, find your niche, take what the market gives, be patient, never think you have learned all you can learn and instead view trading as a lifetime of learning, be honest with yourself, keep a trader's journal and above all, practice responsible risk management on every single trade you enter.

I can't make you a great trader, I can only provide information, my experience, an occasional second opinion and support. Chris was gracious in his comments, but his performance is of his making, not WOWS. He just uses the information the same as a hedge fund uses professional networks and sadly, inside information. You and you alone are the only person that can make you a great trader.

Now, for a turn toward the ridiculous. I watched this video just before I started this post and I thought after a long day in the market, some of you animal lovers might get a kick out of it. This is my Vizsla puppy, Emma. She was about 7 months old when I recorded this as I worked from my porch. It's so funny to watch a new life find wonder in even the smallest of things. I hope you find it as fun as I did.

MORE POSTS ARE ON THE WAY....

Here's Emma!

No comments:

Post a Comment