I think I'm going to take 1/3 of my profits on my short positions and hope to re-initiate that 1/3 at higher prices, if not, then I'll still hold 2/3rds. I have a feeling that the Troika will not dump Greece just yet and a short term pop could come out of an announcement that they have met conditions for the next tranche. However, we are still at the start of a distribution cycle so I see it as a short term bounce if it actually does materialize. You can judge by the charts thus far, but I'd rather not take a chance here and I'm maintaining the bulk of my position.

DIA 1 min relative positive divergence

DIA leading negative divergence

IWM 1 min in line

DIA 15 min negative leading divergence

IWM 5 min strong relative positive divergence

IWM 15 min in line

QQQ 1 min positive divergence

QQQ 5 min in line

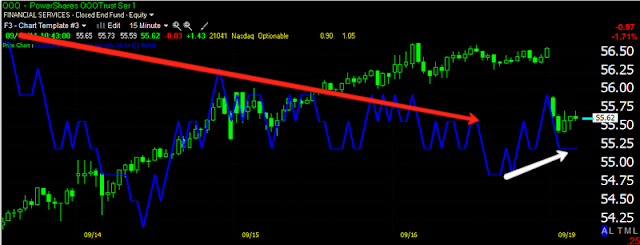

QQQ 15 min, slight positive divergence

SPY 1 min positive relative divergence.

I have a feeling we may see an intraday bounce, perhaps on the Greek/Troika news, the long term charts are negative still so I hope t will be a chance to add the 1/3 bak at higher prices. Either way, I think the market has a lot more downside to go over the next day or two. It may be a good opportunity, if it comes through, for people to get into the short ETFs we have been using, which are broad market ETF's, leveraged and inverse (meaning you buy them, but you get short exposure.).

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment