Commodities remain dislocated from equity, but made a move this afternoon higher.

That can probably be explained by oil to a large degree that may be pricing in some geo-political risk as the situation in Iran is very unclear as to why things are exploding with no good answers.

Still USO remains in a momentum stall here and I'm still holding oil shorts.

The Euro took a plunge on the republican legislation, it still remains dislocated by at least several hundred Dow points.

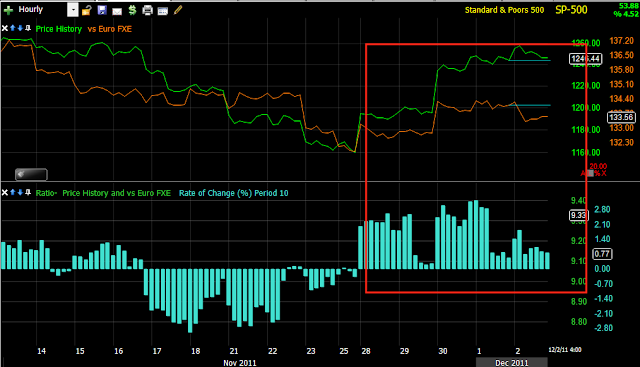

Here's the larger view of the dislocation between the two assets that usually travel in lock step.

High Yield Credit which remains severely dislocated is moving lower toward the close.

And rates today took a plunge, they also remain severely dislocated and equities tend to gravitate toward rates.

Financial momentum vs S&P momentum picked up but is now leaking lower.

As you an see XLF is testing intraday support now so the close should be interesting.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment