Commodities again this morning not breaking to new highs.

The wider view showing them being dislocated after initially or originally being strong performers.

Here's another way to look at the relative performance of commodities vs the S&P over the last 2 days.

And USO vs the SPY (red) over the last 2 days.

High Yield hasn't been able to break above last weeks highs, the scaling is difficult here, you must compare the Green S&P at last week and see how it has moved vs high yield not having moved at all, a serious disconnect.

Here's another way of looking at it with the scaling problem. The red trendline extends to last week.

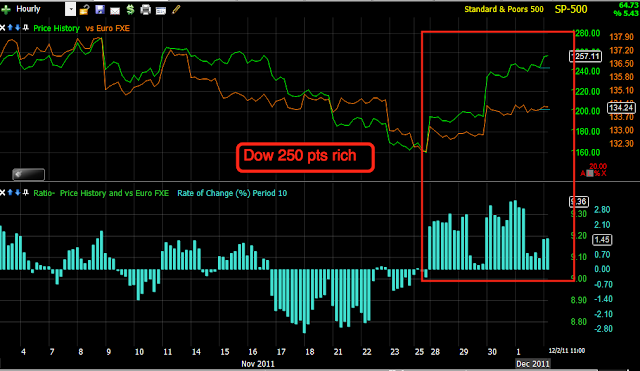

I said I would figure out how disconnected the Dow is vs the Euro, as of the start of the bounce where they were close to parity until last night's close, the Dow is at least 250 points rich as of last night.

High Yield Corporate Credit remains dislocated.

Rates haven't broken higher all week, while the S&P has, another dislocation that is difficult to see because of scaling.

The quick and dirty CONTEXT model is leaking lower with ES overall since the 8:30 NFP release.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment