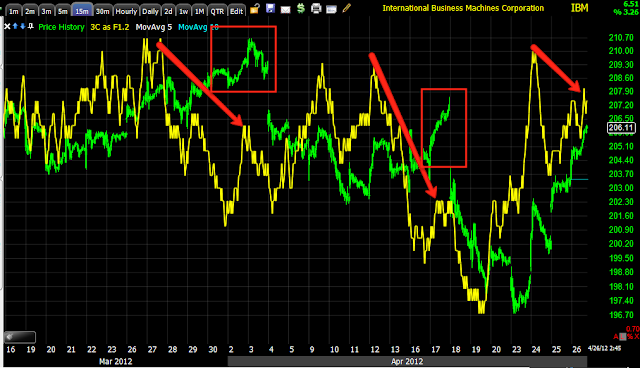

Yesterday I put out some target areas for IBM, so far so good.

IBM has made it through the major resistance zone at the bottom, it's now taking on the second zone at the higher red trendline, I think it can still make it to the small gap at the yellow area. If IBM's Beta wasn't so low at 0.61, I would consider starting a position here. Given the beta is low I personally would only take the trade at the yellow zone or better as a concession for the low Beta.

I pointed out last night that IBM tends to go negative in to what almost looks like a dog's tail (see the red boxes) and 3C is deteriorating on the 15 min chart, it is not as bad yet as previous divergences sending IBM lower. The price move itself since the 23rd is more volatile and parabolic than the past moves and longer lived, this makes perfect sense as market volatility has increased, so again, for the trade to be worthwhile for me, I'd want the concession of a higher price entry which also gives you a lower risk profile.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment