In any case...

I don't like the trade I see in AAPL at all, but I still think its important to be patient as short term emotions and short sighted analysis often ends in the right conclusion, but a trade you are stopped out of.

Yesterday's closing candlestick concept seems to have worked pretty well in AAPL thus far, remember though, there's no measuring implications with this concept, it's just the next day it's very likely there's a different direction as we see thus far today in AAPL.

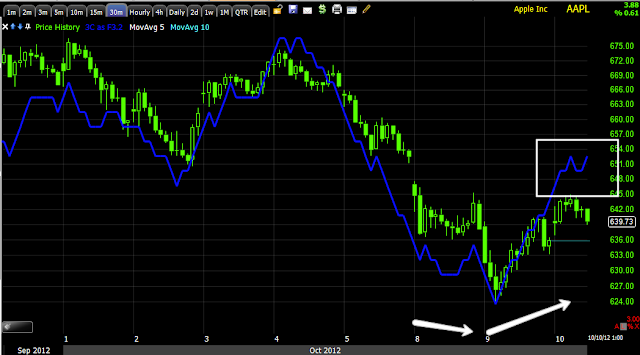

Here's the intraday uptrend since yesterday almost off the open, it's a little below the trendline and that's going to make traders nervous.

Beyond that, I just don't like the 3C charts in AAPL, like this 5 min that is negative at today's intraday high, although this can change a lot with the next 3 hours.

As of Sunday night I was looking for a consolidation that leads to a move to the upside in AAPL to form a final shoulder, it looks like we won't see a move quite that large, but AAPL has started to do what was expected Sunday as it turns up from Tuesday's lows.

This longer term 30 min chart that has been in line, has a positive divergence as it is slightly leading, this is not STRONG, but still suggests there's more upside in AAPL, the alternative would be this 30 min chart VERY negative and AAPL ready to crash immediately.

Furthermore, behavior wise, AAPL's H&S is probably one of the most visible of the year, the more visible these price patterns, the more likely they get manipulated and H&S patterns already get manipulated a lot as the shorts from the break below the neck line get squeezed out on a volatility move above the neckline. So we have some resistance in the yellow gap above, and the target still looks to be above the neck line, that's where I;d feel good about getting short AAPL.

No comments:

Post a Comment