Here are the early indications in which you will see some early positive divergences and I've included the bigger picture along the lines of the pullback and this is why I say I expect this move down to last more than a morning, more than a day so I wouldn't get worked up about intraday trade, the highest probabilities rest with the longer timeframe charts.

Remember, the last thing Wall St. is going to do is make it easy to make money, just when the market collapsed this morning a bunch of traders who suspected it might, but failed to take action like we did when it mattered (earlier this week) jumped in short this morning and just about as soon as their orders were filled and they were feeling smart (for chasing the market), the market throws them a test of their conviction and the doubt creeps in and so do the BTC orders, we don't chase, we don't take trades on gut feeling and we don't let intraday or even day to day moves shake us off a trade when we see high probability evidence. Emotions are a great reverse indicator, they don't have any place in making unbiased decisions.

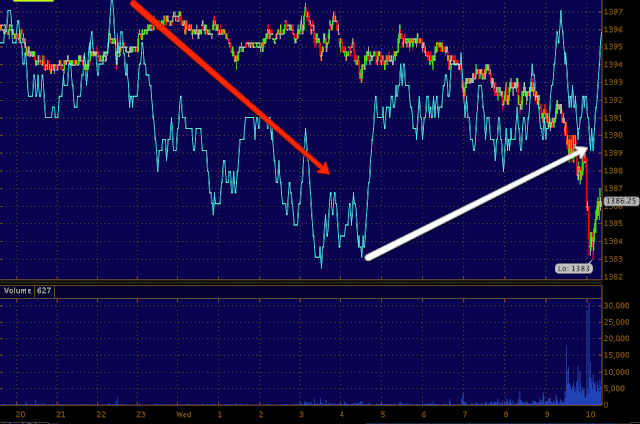

The 15 min, which is a significant timeframe for us with a head fake move that saw distribution as it failed and a leading negative divergence, this not only told us today was coming, but that it's going to likely be much worse than what we just saw.

The IWM 1 min did confirm the gap down and put in a small positive divergence intraday...

The 10 min going from positive before the 16th to leading negative the last couple of days also points to a move that lasts more than a day.

QQQ 1 min didn't quite confirm, not surprising for early action.

The 5 min chart shows the negative divergence, it's along the lines of a multi-day pullback

But even the QQQ 15 mi n is neg.

SPY 1 min confirmed this a.m.

The 10 min chart has a strong leading negative divergence, the FAZ calls should do well, my only concern is volatility.

Here's the ES 1 min chart posted before the open, a negative divergence after the European open took ES lower and we saw a positive divergence building, again it's early trade so it doesn't mean much other than the intraday signal it is giving.

The NASDAQ futures were negative all the way out to 15 min after having shown good trend confirmation, so again as I have said all week, I expect this to be an ugly pullback, but it won't be in a straight line, there will be lots of volatility and shakeouts because Wall St. isn't there to make you money, they're there to take it from you.

The TICK -remember it got real nasty yesterday afternoon, this a.m. it was very nasty too, hitting -1400, but shortly after that I saw some +1250 readings.

Just be patient...

No comments:

Post a Comment