I'm not sure what exactly this is about, there's a chance it is about the Debt Ceiling debate as Boehner (Grand Poobah of the Republicans in the House and House Leader) kicked the can to Senate Democrats, saying if there was no budget, there's no talk on the Debt Ceiling. The House will propose a 3 month extension of the debt ceiling in exchange for spending cuts from the Senate according to Dow Newswire. The House is expected to pas the 3 month extension next week (although Boehner couldn't gather enough Republican votes to pass his plan B).

Honestly this seems to be more theatrical than anything, to dare to imagine a budget with spending cuts comes out of the Senate is to imagine a flying pony named Wilson.

Whether the VIX move down was in response to this is unclear, but if the debt ceiling is moved out further, than like last time, the VIX is sold as hedges are moved out further to try to cover and hedge exposure around the area of the debt ceiling fiasco/debate. I'm not sure traders actually are falling for this and thus taking that action, but we have seen it once before and that's how the market figured it doesn't need to ramp AAPL to ramp the market, it's easier to use the VIX.

If this was a ramp of the VIX to try to support the market or move it up to some op-ex pin, then that's another scenario, the other is that this is a capitulation move, massive shakeout which is something that would fit right in with a move higher in the VIX expected as it hits all kinds of stops, orders, and creates massive supply which of course is something Wall Street needs and judging by the momentum in the Financial 3C charts alone, I'd say we are at the point in which buying the VIX (derivatives) on this move probably sounds more reasonable than anything (as difficult as that may be to swallow).

The VIX ix now at new lows stretching back to June or July of 2007, this is EXTREME complacency and a hallmark of a market top, a big one.

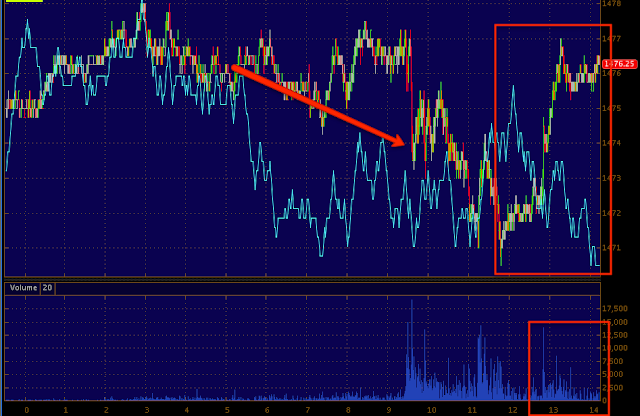

Here are some of the charts, the initial move in 3C as volume swelled was one of positive divergences, of course that would be the point of creating supply.

The Euro (red) is not the lever today as you can see vs the SPY (green), it doesn't have the juice to "juice the market". I believe a Credit short squeeze was used as mentioned last night and this looks like they are going back to old faithful (of recent), the VIX as the lever, but why? Is the selling in the market that strong that their pin is endangered? Is this hedges being rolled forward on a 3 month extension of the debt ceiling? In either case, it doesn't seem to matter judging by the looks of the charts, the probability of this political ploy actually going anywhere and the reaction of the market during the move up as the VIX moved down, it wasn't even confirmed.

ES is in a new leading negative low on the ES move up as the VIX was money hammered down, look at volume too (although late Friday on a 3 day weekend is probably a big part of that.

The SPY saw a negative divergence as well on the move.

Oddly, the SPY (green) didn't move anywhere near the correlation you'd expect when comparing the intraday VXX (red). The correlation would suggest the SPY moves above yesterday's highs on a new VIX low, that comes back to the question of, "Just how weak is the market right here and now?"

The daily chart of the SPY looks like it will end with a Dominant Price/Volume relationship today, this is something I thought we might see just before a reversal as I mentioned maybe 2 nights ago. I would guess the relationship would be "Close Down/Volume Up" which is the most bearish relationship among the 4. We don't need SPX volume to be higher, just the component stocks.

The VXX reaction and it keeps moving positive.

The weekly VIX at a new low stretching back to 2007, around the area of the last MAJOR market top that wiped out 5 years of gains in about 16 months.

And the volume of the VXX as it breaks below support, this is one of the reasons for head fake moves, the supply is created that large positions need to buy at good prices and not drive price against them.

My first instinct after looking at these charts was, "Buy volatility", like Warren says, "When there's blood in the streets..."

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment