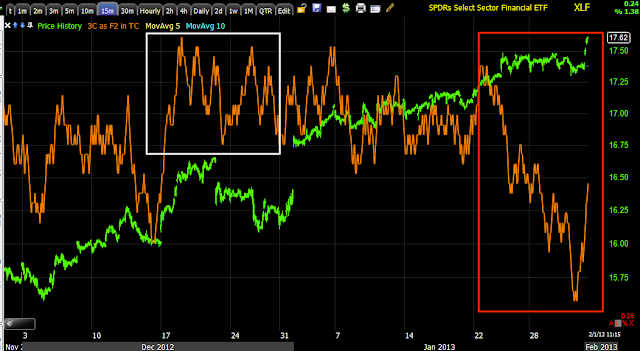

For the S&P to be up, Financials need to be p, just like the NASDAQ 100 needs tech for support. I have updated Financials several times this week, but haven't moved on them yet. In one of the updates I mentioned that the obvious range in XLF would be hit on the upside, there are just too many reasons not to when you're that close and this all create the rising volatility a well.

In any case, Financials may in fact be creating that window of opportunity, perhaps today.

Here's what I've been looking for, what has happened and what needs to happen to finally take a position in FAZ long or fill one out.

Here's the 7 day range in Financials and today's break above them finally. The volume is there, which is good, that's the reason for the range and break above. I don't want to pull any trigger yet, but I do want my finger on the trigger.

One of the most common areas to see distribution in a trend like this or accumulation in the opposite trend is during flat areas or trading ranges, it gives a stable VWAP and fill for institutional clients, the break above the range as a head fake move is typically the last event in a series of events before a reversal, it's a head-fake or failed move and there are a lot of reasons as to why if you read my first 2 articles of the 3 part series, "Understanding the Head-Fake Move".

I have little doubt this breakout will be proven to be a false breakout as the chart above suggests the probabilities were already very high before it even started.

Here's a 1 min, very short term positive divergence that suggests the move to the upside is being prepared for by smart money, much in the same manner we just made a quick trade in the Q's.

Of course even the 5 min chart looks horrible and had very little chance of coming back. Now we just need to wait for the 1, 2 and 3 minute charts to turn very negative while price is above the range and we have an ideal entry for a Financial short, I prefer long FAZ.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment