I could go on and on about a lot of things in the market today, the VIX losing nearly 9%, but still holding the "Rising 3 Methods" bullish reversal pattern, the incredibly light volume and trade size everywhere, the beat-down in AAPL, market breadth measured in TRIN and TICK being exceptionally thin, the S&P up +0.46% while the $USD was unchanged, the EOD ramp on no volume, the S&P trading under the trendline broken on 2/20 and the Trend Channel on 2/21.

Context remains negative and getting worse...

In to the close I think these are worth seeing...

High Yield Corp. Credit failed and wanted nothing to do with the afternoon ramp.

Junk Credit did the same thing.

All of this is totally a moot point though, there are only 4 charts, really 2 that were the reason for this post, before we get to them we are going to take a quick look at currencies, they are connected to the market in an important way and the signals we are getting tonight are important enough to warrant a post...

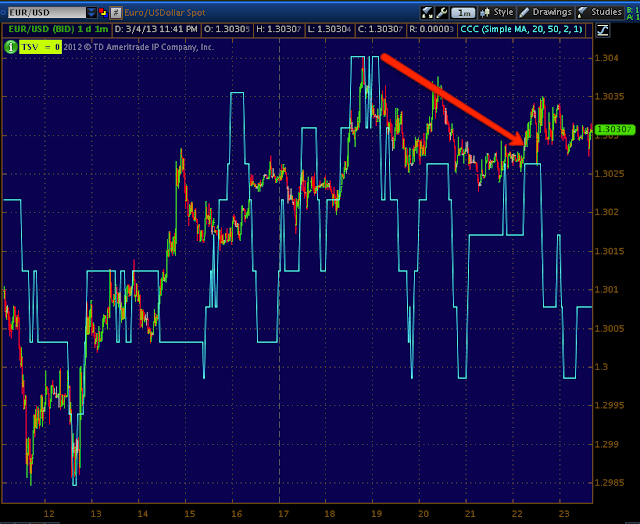

The EUR/USD has a small divergence on the 1 min chart, this isn't of a lot of consequence in my view, in my opinion it shows a sort of parity between the two give or take a little here or there.

However the divergence and move in the USD/JPY shows the Yen seeing a strong move vs the USD, keeping the EUR/USD in mind.

The AUD/JPY is showing a good size negative divergence as well. I'd say the carry trade pairs that are part of the typical basket are going to the hot place in a basket.

However... these next 4 charts are the reason for this post.

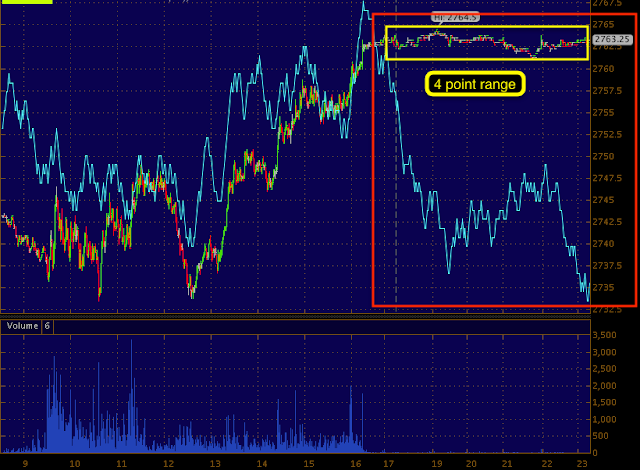

This is ES (SPX futures) on a 1 min chart, there was some strange and bearish volatility in 3C on the afternoon ramp, since then a very tight range of 3 points (flat ranges are where we most often see large divergences). If this were the only divergence I would probably say, "We still have a long night so this is important, but we'll have to see what it looks like in the morning", but this isn't the only signal.

Look at ES's 5 min chart, that's a VERY sharp leading negative divergence, this is the kind of signal we'd buy puts on, but it's even deeper and faster than past divergences we've seen, I have to think some form of this negative divergence is going to hold overnight, it's just too sharp, to strong, too fast. To me, this is a VERY strong signal, considering this morning was so "blah", this is a huge change in character as well.

It's not just ES...

NADAQ futures (1 min) are showing the same signal and in a narrow 4 point range.

Again, the 5 min chart looks like ES, an incredibly sharp, deep negative leading divergence.

These 4 charts are the entire reason for this post at midnight.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment