Well it really isn't the US Index futures that show some excitement, ES is about 1 point above Friday's 4 p.m. close so pretty flat, the 5 min charts continue to drop negative, but we're just getting started.

The excitement was Japans trade balance miss, the 30th month in a row and the biggest ever which has sent the JPY down and guess who up? The $USD as we were expecting...

Since this is the 15 min positive of the $USD. the move is hard to see being there are so few new candles, but it's up.

As for Carry pairs, the AUD and EUR vs the JPY are up a bit, but very choppy.

The Nikkei however is up as bad news is good news in the land of the rising QE. However I'm not all that impressed wit the move as of yet, the 5 min is still negative, but again the night is young.

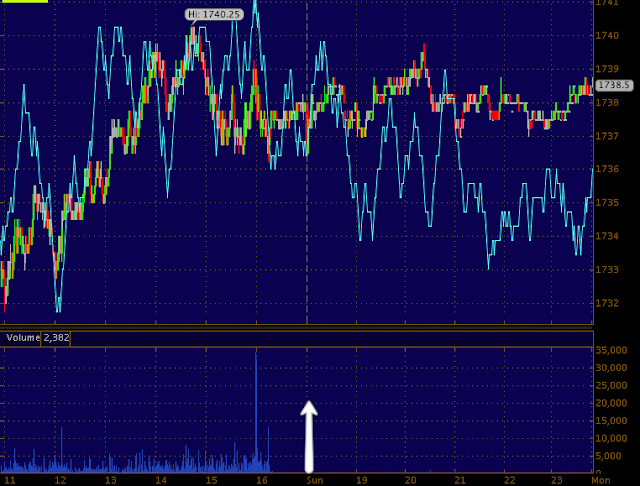

Nikkei 225 futures 5 min

I'm interested whether the rising USD and falling JPY act as a positive carry or the historical legacy arbitrage for the $USD such as we saw last week says, "strong dollar=weak market.

The pair look like this.

USD/JPY 5 min chart, the positive divegrence here is mainly due to the positive $USD 15 min chart, still the pair looks ready for a turn higher, the question is does it act as a carry pair and supportive (I suspect so) or does the same Legacy Arbitrage of the $USD from last week continue, if so the stronger $USD brings commodities, oil, precious metals and stocks down.

Oil is totally flat and not giving any hint. Gold has a 5 min negative, but that's the same thing seen Friday and the reason I suspected gold and miners fill the gap, I think they are a buy or add to at that pullback. So far Silver futures are in line with 3C and not much help, silver does look pretty good tonight so far.

To show you how dull it is for US Index futures thus far...

ES is now up 3/4's of 1 point since Friday's close, virtually flat.

That 5 min negative is still there, but it's way too early to expect to see any significant changes on a 5 min chart with Index Futures open for about 5 hours.

So we'll check again in the a.m.

I would seriously take a close look at gold and GDX, set some alerts for a pullback/gap fill and I think you might get a nice swing trade on the long side in to the pullback, maybe a 2x leveraged gold ETF and NUGT for GDX?

See you in a few hours, MAKE IT A GREAT WEEK, it's yours!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment