First let me tell you I have to leave at about 3:45 to be at a 4p.m. Dr.'s appointment with a plastic surgeon, this was the best appointment I could get to miss the least market time and had to wait 2 weeks rather than take one 2 weeks ago in the middle of the day. I think I mentioned this, I had something cut off my face about 4 weeks ago or so and the biopsy came back as skin cancer, it's not a big deal except for the fact it's about a half inch under my eye, anywhere else and the scar isn't a big deal.

I think I have some surprise coming because we were suppose to just schedule the Mohs procedure after the biopsy came back in case it was cancer, however after it came back, they skipped scheduling the procedure and said they wanted me to meet with the surgeon to discuss "My options", so I'm not sure what that's about, but I'm more worried about missing the last 15 minutes of the market honestly, at least right now!

So I'm looking at the market, there are plenty of negative signals and price coming apart here and there and I'm seriously considering a position, options or I have room in the trading portfolio to fill out the half size FAZ and SPXU positions, but I have a gut feeling, I can't quantify it or give you an objective perspective in charts, other than to show you these few.

My gut feeling is that this negative divegrence which you can see below in the SPY (which has grown quite bad today) is going to get much bigger, as in "Screaming".

SPY intraday 1 min leading negative quite badly, well below last Thursday/Friday and that developed quickly today.

As I said, the strength today was only skin deep ( 1 min charts) as this 2 min was already negative, never confirmed or even tried today and just got worse, well below any reading for more than 4 weeks, likely more.

5 min, again it's really interesting with that positive we saw just before the FOMC and kept out longs until after and even entered a new 3x long position just before the FOMC, but right in to the gains, distribution of them and continuing in to Quad Witching.

10 min with progressively worse divergences at about equal tops except the very last one, I usually highlight head fakes in yellow boxes.

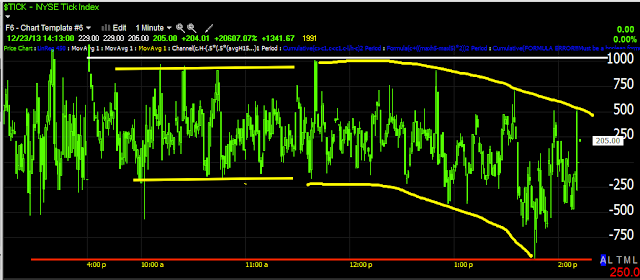

Today's TICK, it only hit +1000 and now it's clearly turning down and has hit -1000. TICK should be hitting +1250-+1500 on a day like today, but nada. I look forward to tonight's breadth readings.

The 5 min Index futures are exactly where I want them to enter trading shorts or tactical entries for longer term positions.

I feel like this is going to get worse.

This really got me, the CBOE SKEw Index (they put out the VIX as well).

According to the CBOE, the highest the SKEW has hit (the higher the more chance of a black Swan market crash) Oct 1998 in the middle of the Russian Crisis, to which the F_E_D launched a massive Surprise Cut in both the Fed Funds and Discount rate to counter what was about to happen, that reading was 146.88, we are at 143.19. Another was the July 1990 recession, SKEW was elevated just before in June, so this SKEW reading or Black Swan Index is really at a very high level historically.

I have no problems with the open positions, I'd have no problems adding them today, but before I add the last half to these or open options, I want to see if my gut is right on this one. I would suspect that we'd see something very ugly right before a major move and I want to give the market the time to do that.

If objective data changes my mind or reinforces the gut feeling, I'll of course post it, but watching how things are going, I just get a more ominous feeling than just the normal 5 min negative index futures and other signals, I'M LOOKING FOR/ OR SUSPECT SOMETHING SPECIAL.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment