We know the negative divergences are there, the breadth via intraday NYSE TICK is VERY ugly, that said...

I see a lot of what I call "Steering divergences", these aren't meant to accumulate or distribute, they are meant to move price or most often pin price at a certain level, in this case it looks like it has been trying to keep price pinned not too far away from break even, however at the same time the USD/JPY and the Yen and $USD futures are seeing growing divergences which should send the USD/JPY lower, that move hasn't happened yet, but it would likely be a more effective way to move the market to the downside, instead of just letting it float down on retail trade, have all of the algos kick in at once and move the two together... this is the general gut feeling I get.

There could also be an attempt to stabilize the market for a knee jerk reaction, but typically they are right away, thus the name "Knee jerk".

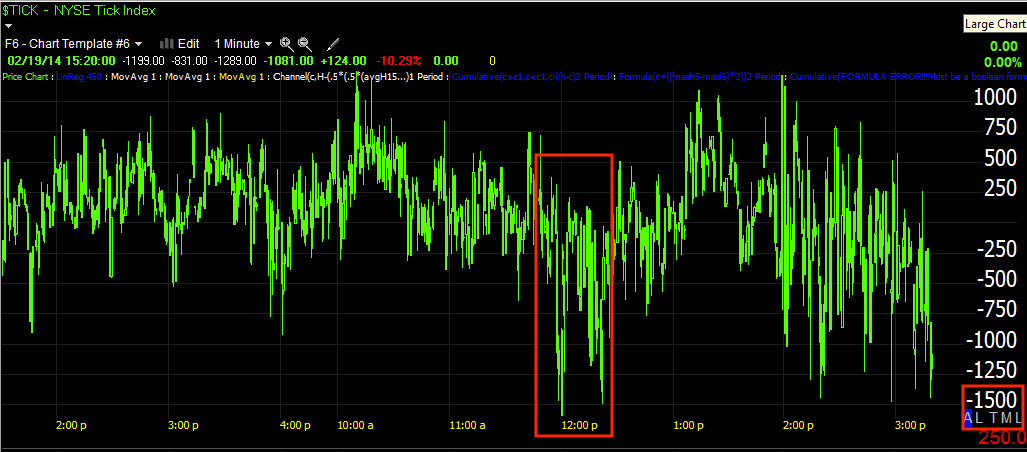

Here's an earlier example of how the market was getting in to trouble around noon time and there were some steering divergences to stem that downside trouble that was building as we had hit a downside negative TICK extreme of more than -1500, note how bad the current TICK trend is as well.

Earlier the market trend was turning down and started to get really serious with at least 1500 more NYSE stocks moving down than up at the moment, that was stemmed at least until the minutes came out. Now you can see a clear trend in TICK to the far right and it's once again making multiple probes below -1500 which is bearish for the market.

Here are some charts that make things a little more clear, I have a lot more to look at.

ES with numerous small steering divergences to hold off any get away on the upside or downside.

The same for NASDAQ 100 futures

And for Russell 2000 futures.

Again, a possible reason is that a downside move leaving the longs holding the bag and completing an effective bull trap in which the door is shut hard on them would be to move the market down with the USD/JPY which looks like it's close to making a downside move, just not completely finished with it's set up.

This is the Yen futures overnight, their strength meant USD/JPY and Market Index weakness, pre market there was a small negative divegrence and a move lower allowing the USD/JPY to move up and allowing the market some support from the USD/JPY moving up, however since then, the lows in the Yen intraday have been under accumulation for a move higher (sending the FX cross and Index futures lower).

The other half of the currency cross / carry trade is the $USD itself, here the $USDX is seeing a negative divegrence which would confirm the signal the Yen is giving and result in the USD/JPY losing ground and perhaps taking out the $102 level which would certainly be felt in the market averages.

This is the USD/JPY itself, you see the early positive divergence I showed several times today, enough to provide the market with some support, without this I don't think the market would look to good right now, but the divergences all seem to point the same way and that is for the next trend to be down and as you know, I suspect the SPX 200 sma as the first stop.

The divergence here is in keeping or confirmation with both the $USD and the Yen.

Gold futures, it made a pretty sharp move lower. At least the DUSt long is open.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment