Our local surf shop's wave report always says, "Pray for waves", living in South Florida, that's about all you can do as the Bahamas blocks 90% of the swell. In any case, looking at the market this morning that's the first thing I thought of, "Pray for a little bounce, maybe intraday...

Yesterday in the End of Day Report EOD Update I started it with,

"As far as 3C signals, today they were as you'd expect for a head fake move which would just be a run above the rounding top that was already in place, the head fake move itself occurs about 80+% of the time before a reversal in any timeframe, whether you are looking at 15 min charts, 5 day charts or intraday 1 min charts. The head fake move is one of the better timing signals we have when we already know there's an underlying trend of distribution or accumulation."

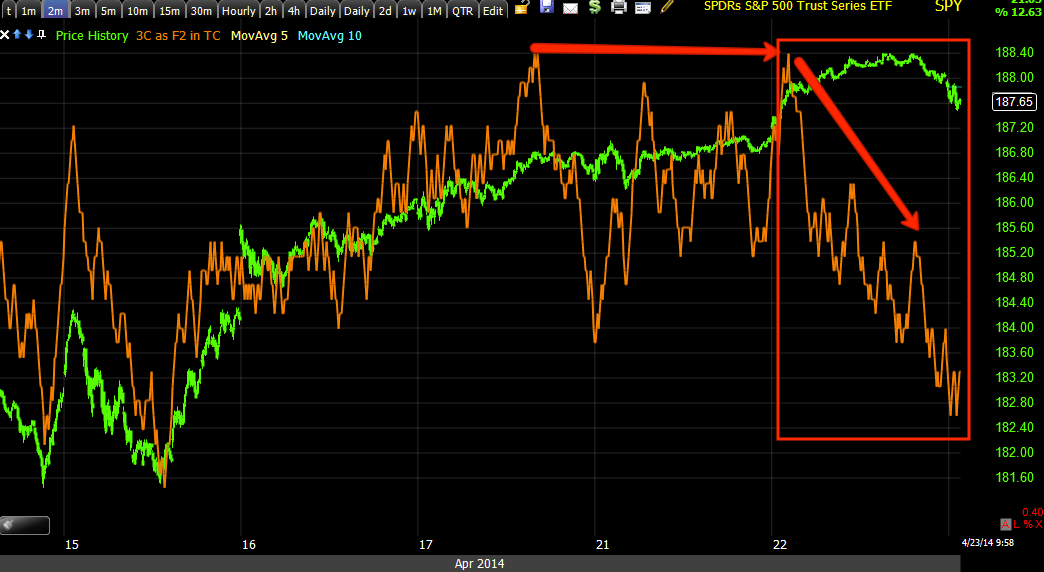

Looking at the SPY charts, it's amazing how clean the signals for a head fake move yesterday were. You may recall that I decided to leave what was already established for a move down in place rather than add to it at this time because some targets on the upside had not been taken out. Looking at the charts all I can think of if, "please give us a little bounce" because with that I believe we will have a larger opportunity to play the downside move in greater size with the charts and objective data to back up that kind of decision, perhaps a bounce to the targets I talked about that were missed in a couple of the averages yesterday. From certain charts, it looks like that "may" be a possibility, lets just get to the charts so you can see for yourself.

SPY 1 min at yesterday's head fake, a very clean divergence that is leading negative

SPY 2 min, there's the migration of the divergence we were missing Monday.

SPY 3 min, very nice leading negative, but here's where it gets more interesting...

look at the leading negative on that 5 min chart, that's like pure, uninterrupted, large scale distribution.

The 10 min chart is doing the exact same thing, just not as deep yet because of the concept of migration of a divergence.

The 15 min chart is negative enough that just adding a bit more and/or knocking the 30 min out of kine would be justification enough for me to enter in larger size on the short side.

Remember the 60 min chart is already trashed, there was no positive out to that time frame so it's just the 30 min.

The QQQ and IWM look the same, although I won't post all of the charts...

QQQ 15 min

IWM 15 min...

And why might we get a little bounce?

This is the QQQ 1 min with a small intraday positive, that could be the little bounce that allows us to add in size.

Here the IWM 2 min has the same, both IWM and QQQ have 1 and 2 min small positives like this, they stop there, they don't reach the 3 min chart so a little bounce looks probable and would be VERY useful.

I'm not saying the 3 min or longer won't go positive, just that they are not now, the important thing is the 5, 10 and 15 min charts and how bad they look and how quickly that happened.

I'll keep you up to speed, for now I'm not making any changes in positions.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment