I like to keep options trades as short as possible, at the first sign of a loss of momentum I want to be able to sell a call in to higher prices and a put in to lower prices, I don't want the premium going south on me when I'm trying to unload them. So I may not get the BEST exit, but I get an exit, I reduce my market exposure and wait for the next set-up, if I get stuck holding an option longer than I had hoped, I'm usually ok because I'm almost always going with expirations that are 2-3x longer than what I think I'll need. The next set of QQQ options (or wherever they may be) will be out to May monthlies, this isn't the way to hit home-runs with options, but I'm not using them for that, I'm using them as a tool to give an otherwise decent trading signal the profit potential that makes the position worthwhile when an equity trade just won't do. I've blown up an options account trading the way they are designed to entice you, buying out of the money with short expirations and holding way too long, these are Wall St. derivative products meaning they're like Vegas, if you sit at the table long enough you lose so I do everything the opposite of what their allure is, buy in the money, buy longer expirations and hold them for the least amount of time possible, you can always re-enter.

With a cost basis of $1.44 and a fill of $2.10, the QQQ April $85 (not $90-my mistake) came in at a gain of +45.8% which isn't bad for 2 days.

I had an idea yesterday of what I was looking for in the market and last night's futures action reinforced that idea.

Essentially I'm looking for something like this using the Q's as a proxy for the broad market, although each average is in a little different situation.

QQQ 10 min, the base that's in and divergence is already plenty strong to make the targets I posted yesterday, but with the carry trades and some signals in the intraday charts, I expected this based on the information available at the time...

A "W" shaped pattern larger than what we saw starting to form in the late Friday divergences. I put in a head fake move/stop run on the second bottom because that would be the highest probablility before a base like this breaks out.

The TICK data is not conclusive on its own, it's just another piece of the puzzle that supports the same theory (this is my custom TICK Indicator)...

SPY vs. NYSE TICK data (intraday).

So I needed to make a choice quickly this morning with time decay becoming a larger factor, I looked to the opening indications to see if there was confirmation of the open or not as we already had intraday signals suggesting some pullback in the averages is coming...

This is the QQQ shortly after the open with non-confirmation which taken with the other averages made up my mind to close the QQQ April $85 Call position.

This is the larger 3 min intraday divergence that was already in place as of yesterday putting short term probabilities a bit more on the side of a pullback and a "W" base.

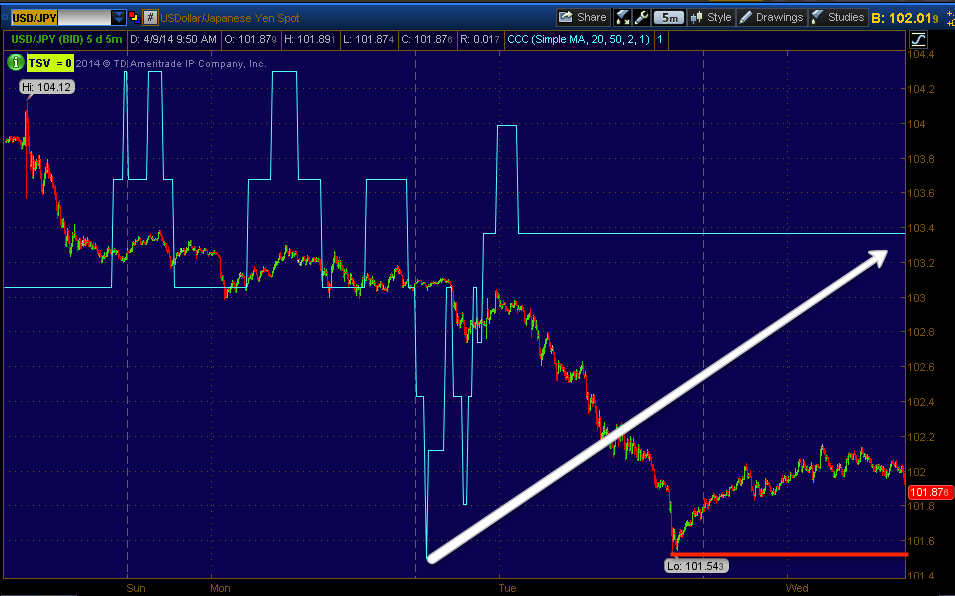

I checked the Carry trades (actually USD/JPY) to see if what I saw last night was still holding and it was...

The $USDX 5 min chart that needs to move up for the USD/JPY to move up saw accumulation of a first low in what I suspect will be another "W" base and then some overnight distribution which would be needed to send the $USDX to its second low in a "W" base.

The 5 min USD/JPY is supportive of some small base forming here with a positive divegrence in 3C, I suspect that will be a "W" base formed at the same time as the QQQ/market and then they'll turn the Carry Trade correlated algos back on.

The intraday 1 min USD/JPY was also supportive of a pullback which would be a needed first step in creating a "W" bottom/base.

As for the other opening indications, they supported the Q's...

Here's the SPY not confirming the open...

The IWM

And the DIA.

So it's about waiting or being patient for the next set up to materialize.

There may be a trade on the downside, perhaps a QUICK put position, I don't think an equity trade would have the profit potential to make it worthwhile and with those 10 min QQQ leading positive divegrences we really want to be sure before entertaining the thought of a put position in what would be very speculative trading.

I'm going to check on some other assets we are involved with or that have been mentioned recently as potential trades.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment