We ended last week with the SPX down -.90 for the week, the Dow -.75%, the NASDAQ composite -1.57% and the Russell 2000 -4%. What I found over the weekend was that 6 of the 11 main Morningstar sectors were down more than 2%, which is significant as these are sectors.

Thus far, the Dow is leading trade, which seems to be about 17k more than anything, however there looks to be a loss of momentum which is not a great sign this early considering the psychological level is broken, look at a 15 or 30 min candlestick chart and you'll see what I mean.

The Russell 2000 which seems to respond better to a 50-day exponential moving average rather than a simple had the two Star/Doji reversal candles I pointed out Friday, but the gap up there is not that impressive thus far considering last week's drop and the help it and small caps are getting from the MSI.

As expected, TLT, VXX and HYG all moved in the direction of the SPY arbitrager, however TLT isn't showing much damage, I'll take a closer look and HYG is not looking good at all on opening action.

HYG's gap up this morning as expected last week (I showed the positive divegrence there and negative in VXX and TLT), however the gap up faded quickly this morning.

The NASDAQ Composite has some serious breadth problems as the A/D line has given way.

This is the Most Shorted Index which was slammed last week, I suspected this would also help lead the market after being hit so hard last week, it is still trailing though.

The IWM intraday thus far gapped up off of Friday's closing positive divegrence, but not showing strong confirmation so far, although it is still very early, but these are the things I'm watching for to determine how we should proceed.

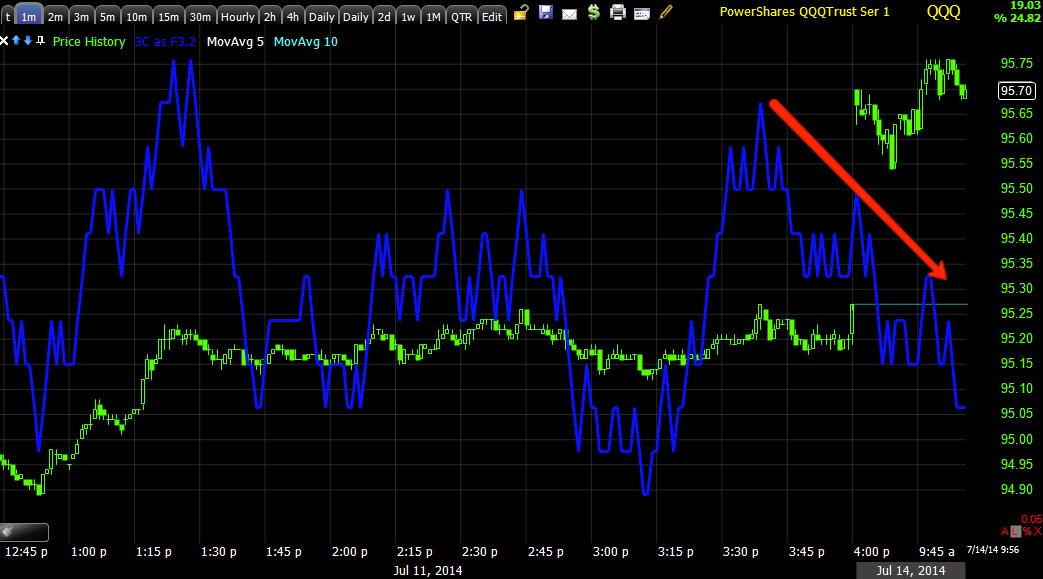

The Q's also don't have very good confirmation of the gap up this morning.

The SPY's looked the best, but since this capture it has started falling apart, now...

Most current SPY capture, the Q's are seeing similar 3C signal deterioration.

And while the TICK opened enthusiastically, it hasn't held that enthusiasm.

MCP calls from Thursday are up +133% and for now I'll hold these, but I usually get out of positions like this quickly so if I feel there's not a bigger move in store very shortly or a correction will come before any move higher, I may exit the position quickly and look to re-establish it.

Our SCTY and Z shorts are also in the green, but I'm going to take a closer look to see if there's anything that suggests any management should be taken for those or just left in place.

Also DUSt which we opened Friday is up +6.6%, I do suspect we will see a larger pullback in GDX as it sits just above support so I'll update the position and GDX, but suspect that this will stay in place for the time.

Thus far I'm not overly impressed with this bounce which I'm most interested in determining whether it is a true bounce of the Wall St. set up kind or a series of lower highs/lower lows as shown with IWM Friday.

No comments:

Post a Comment