As I mentioned before, this weekend is Andrea's birthday and I have "things to do", you guys know what I mean!

Just so I don't feel rushed or leave any question marks, I wanted to be clear again on the Week Ahead and this week. Last Friday's Week Ahead had two options, both were a bounce starting early in the week, the correct one was that we'd see a little more base building early in the week and bounce from there.

I showed quite a few charts that I specifically called out this morning as being on my watch list, they were the timeframes and averages that needed to move, otherwise while we are still in distribution, the reversal process was not at the tail end and boy did they move today, just see the posts today and the The Week Ahead that touched on the 3 key charts. It wasn't just the averages, but Index futures too.

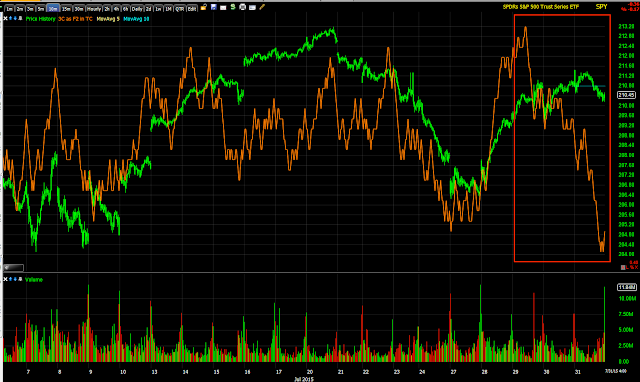

How can I honestly look at a chart like this and not be bearish on the market going in to next week?

IWM 10m

QQQ 15m

SPY 10

A lot of those divergences are worse than the last top from the larger 7/10 bounce.

ES 30 min, again worse than the last bounce at the time of the top.

These have always been the charts I'd describe as "screaming" or jumping off the screen, the charts that I don't ignore.

After looking at a lot of charts and knowing the probabilities of certain concepts like a head fake move just before a change in trend (down), I felt pretty strongly that there is a good chance of a head fake move early next week which is where I'd want to add any option positions and/or additional shorts.

However as far as actual evidence beyond a gut feeling and the probability of our concepts, this is the best I have right now suggesting any kind of head fake which relies on the principle of 3C charts picking up where they left off.

Only the intraday 1 min QQQ ended with such a chart.

The IWM did not.

The SPY did not.

So if we get that head fake move, I'll count it as a blessing, if not, then at least we picked up some additional exposure that should work very well for us. As I mentioned last night, I don't think many people appreciate how close we are to a very significant change in psychology.

If our 3C charts and breadth charts weren't enough, additionally toward the close Bullard, the St. Louis F_E_D President who always moves the market both up and down made it pretty clear today that September was still VERY much on the table, "In good shape for September hike". All of those early gains on the Employment Cost Index were just nullified by Jim Bullard and I doubt it's an accident as every major divergence we have seen in advance over the last year, Jim Bullard has been the pin-point catalyst for the reversal to the day.

As for all of our 3C charts, breadth charts, futures charts... you may be wondering who is selling if equities are still largely above their 200 day in a big flat range. First I'd remind you that all of our concepts are fractal and just like the flat ranges of the last several bounces indicating stage 3, put the market in to context and expand the fractal...

The flat range through 2015...Daily SPX

The stages of a cycle with 1 =Accumulation; 2= Mark-up, 2a= the peeling away from the trend line or the warning that a change in character has occurred that leads to a change in trend. "2b" a significant change in character and 3 -top/distribution . The 3C chart should confirm...

SPY 5 day with a large positive divergence at #1 in line. Around #2 and leading negative divergence in to the change of character and trend change to flat from up, no different than any of the bounce cycles.

Almost every night the past several weeks I've included breadth charts that prove beyond any doubt that more stocks are moving lower, now we have additional color on the charts above and breadth charts from ValueWalk:

"After a slow first quarter of 2015, the private equity industry experienced a revitalization in Q2-2015. Investment dipped by less than 1 percent to $112 billion, holding strong at the second highest Q2 level since 2007. Meanwhile, fundraising fell to $30 billion. Exit volume exploded last quarter to $125 billion—the highest level on record."

See the full article at the link above, but everything we have been documenting is right there, Private Equity, some of the "smartest" money in the room has left the market at record levels.

So am I okay with a head fake move if it comes next week? Darn right, I'd look forward to it, otherwise I think we've been putting together good positions that will see us well in the months and years ahead.

For now, I'm going to try to serve my significant other well on her birthday. Thank you so much for all the birthday wishes you sent to Andrea at the post she has been manning , the Support@Wolf-onWallStreet.com email to deal with any issues that might have come up with regard to the new website which she worked tirelessly to get online for us. By the way, her Birthday is Monday so if you'd like to send an email, feel free (no pressure).

I'll post our transition date for the new website at www.Wolf-onWallStreet.com , it should be Monday unless anyone had any significant problems over the last 2-days of testing, if so, please let us know at the Support@Wolf-onWallStreet.com email.

Again look for that email this weekend, but as of now we are looking at Monday for a transition date.

Have a Fantastic weekend....

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment