Yesterday numerous indications pointed to a move higher today, we have known about the badly lagging 3C signals in the IWM so today's weak relative performance shouldn't be a surprise.

Intraday, we had a great example of why volume is important as I said the following in this morning's Market Update-IWM intraday upside reversal:

"be on the lookout for a large volume spike and a bullish candle on one of the intraday timeframes like 5, 10 or 15 min for example, I suspect it's too early in the day for the IWM to hold these losses without so much as an intraday bounce."

Before I could even finish the post, exactly what I warned to look for as a downside intraday flame-out or capitulation (selling event) took place.

From the same post....

" This is the kind of intraday candle and volume I was talking about that just occurred on the 15 min chart, it's essentially an intraday flameout and we should get a bounce from this level."

Remember what I said earlier, last night and over the last several months about the lost art of volume analysis and how it will be more and more important as we move forward as shown in the Broad AAPL Update ? ALL OF THESE EXAMPLES ARE FRACTAL IN NATURE MEANING YOU CAN USE THE CONCEPTS ON ANY ASSET AND IN ANY TIMEFRAME WHETHER INTRADAY LIKE TODAY OR ON MONTHLY CHARTS LIKE AAPL.

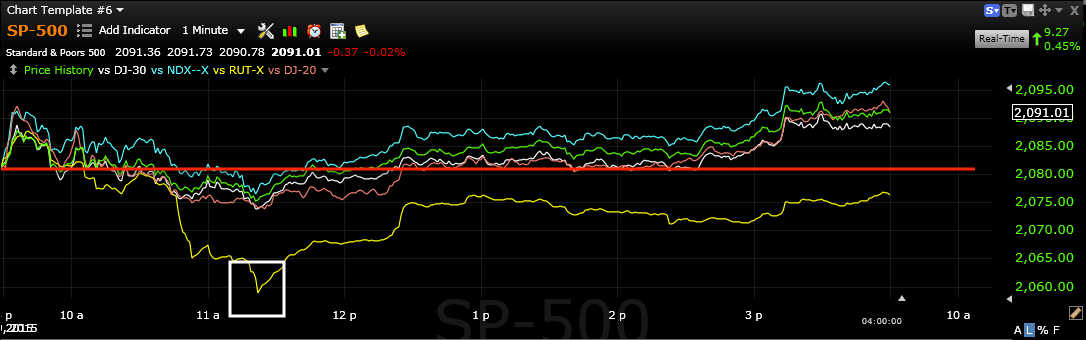

These are the major averages today, note the Russell 2000 (yellow) and the flameout from this morning. The R2K was the ONLY average to show such extreme volume, the others did show the bullish candles, although the volume makes the candlestick reversals about 3 times more effective.

Despite all of this, the Russell 2000 which was the only of the major average not to have a 15 min positive divergence last week when our forecast was for a Triangle/Volatility-pinched breakout to occur this week, ended the day in the red.

As for sector performance intraday, most of the sectors were together huddled around mediocre performance, while Energy led at +1.60% and Utilities lagged at -.43%.

As for the averages since last Thursday's close when the forecast for this week was posted, nearly all of the averages are higher with the R2K being the laggard.

I have tried to be very clear about our expectations for the week, Triangle-based breakouts and increases in volatility. Our market proxy example, AAPL which I posted quite a bit on today, saw what looked like a successful test of former resistance (mentioned yesterday) which has become support at the apex of AAPL's triangle, although the move wasn't all that impressive at +0.76%, it does keep the market on the upside of the triangle which is what's important for now as most technical traders will recognize the triangle as well as the breakout (in some cases we are still waiting) and the test of former resistance/now support, which should give them the confidence to buy.

However as you know, we have been seeing distribution since the first price gains on Monday, as expected in last week's forecast, this won't end pretty, but I don't think we're at the end yet.

As I said, I've tried to be clear about what I'm looking for including signs of distribution in the averages which we have very strong evidence for. The conditions and expectations, example charts and where we are with the other indications I'm watching for are all clearly laid out in today's Status Report post.

As for the Index futures, as shown in this morning's A.M. Update, we are already seeing signs of the 7-15 min Index futures starting to turn which will turn much faster than the averages that are already so deep in to negative divergences that if I was going only by those, I'd likely be calling out pivot , core/trend position entries now.

While we are NOT there yet, here are some examples of how things changed in a day and are bringing us closer with each move to the upside like today's as clearly expected as of yesterday...

Nq/NASDAQ 100 Index futures are already negative on the 5 min chart, it's not that much of a jump to the 7 min then 10/15 min charts.

In fact the ES 10 min is already showing signs of going negative.

NQ 10 min also negative.

This after yesterday morning we confirmed that the highest probability outcome which we already knew as of last week's forecast, has already developed on the 30 and 60 minute Index future charts, making the 7-15 min charts just a matter of timing.

ES/SPX Futures 30 min leading negative, the higher probability chart for this move's ultimate resolution...

And the Index futures are negative on the 60 min chart, obviously the Tf/Russell 2000 futures look the worst which was evident in relative performance between the major averages today.

We are also looking at a second chance short (swing trade) opportunity in USO, we didn't quite get enough of a move to make it worthwhile today in USO, but I believe as posted earlier, Quick USO Update, that we will get that opportunity before oil heads back down to the base it has been working on since January for a longer term long position, perhaps even a primary trend reversal.

Also as we first saw yesterday and posted, it looks like the GLD pullback/swing trade short will also give us an opportunity for any second chance positions anyone may be interested in as posted again today in an update, GLD Follow Up

From a Gold Futures (/YG) perspective...

The 15 min chart turned negative giving us the swing short to the downside expected and after 2 days of near straight line decline, the chart has posted a small positive for a bounce that allows us excellent positioning and the ability to re-confirm the trade...

The 5 min YG / gold futures shows the probability of the bounce we have been tracking today as speculated yesterday.

I have posted on what I believe are building divergences in the $USDX, Yen and Euro with the probability of a EUR/USD bounce and a USD/JPY decline/Dollar decline.

The Currency Futures seem to continue to confirm that developing probability.

$USDX 5 min negative divergence in to higher prices...

And the $USDX 7 min leading negative divergence in to higher prices.

At the same time...

The Euro 7 min futures are putting in a leading positive divegrence suggesting a move higher in EUR/USD which would have pass-on effects to USD/JPY...

As the 10 min Yen futures lead positive as well in to lower prices.

This is to say nothing of the larger daily trend in the Yen with a base and positive divegrence as well as the $USDX with a topping / triangle pattern and negative divegrence, an important sign for the market via the global carry trade that has $9 trillion in $USD liquidity which would have a strong effect on bonds and stocks with 100-300 times leverage, as mentioned last night, if we see what the charts are suggesting, the carry trade will collapse in snowball-like fashion and won't leave any risk asset unmolested with that much carry out there in $USD alone. See yesterday's Daily Wrap for the charts of the longer term USD/Yen charts.

As for the close in the major averages, they were right along the lines of intraday in line and 2 min or longer showing distribution just as posted here late in the day, Market Update.

This doesn't mean that we are done with this move, it just means the move is as we expected thus far, it would be useful to us if we could get a little more upside out of it and a pick up in volatility.

Our target was for the break of the pinched volatility of the triangles, although poorly shaped, they are visible to the naked eye and it's not the price pattern's textbook look that matters, but what the psychology of the price pattern is, thus one of the reasons I used AAPL as a proxy for the market in last week's IMPORTANT: AAPL Set-up & Market Movement forecast that lays everything out.

Although the last 2-days before today were ranging, the Doji star yesterday and the hammer-like candle today, both holding at and above the triangle's apex is a recipe for further upside which makes sense as the 7-15 min Index Futures are moving in the right direction, but not there yet. The averages are showing all the right signals, but I still think it's early without the other 2 sets of signals . Finally leading Indications should have a strong signal, thus I still would be calling for patience in setting up the trade on our turf, under our conditions and at the time of our choosing.

AAPL as a market proxy should see a clean, clear move to the upside on increased volatility, although I don't think the market will have long after that, thus the reason I've spent so much time going through my watchlists today and setting alerts for the best looking trade set-ups.

The SPY is far from a perfect triangle (descending vs AAPL's symmetrical) , but the breakout that is occurring is pretty clear and I think will be much more clear before this is over and our entries are ready.

The Q's have a bit more to go.

As does the DIA.

Remember to see this afternoon's Market Update to see how underlying trade is continuing to respond to any hint of higher or even stable prices above last Thursday's close.

Among leading indicators, yesterday I posted a positive signal in our custom SPX:RUT ration, today it made good on that signal (as well as several other near term leading indicators).

Yesterday's leading signal in our custom indicator while the market was ranging and flat, while today we have non-confirmation and a negative signal which may pass on to tomorrow, but this Leading Indicator does need to break from the SPX and lead more than just a single day for the kind of signal and set up for a true break lower.

This is the same indicator since last week as part of what created the forecast as it led (white) to the upside and has generally been leading negative since which is EXACTLY one of the 3 conditions we need to see.

As for HYG which was covered in great detail in last night's Daily Wrap added today...

While it's the price divergence between HY Credit (blue) and the SPX (green) that counts as a leading indicator as we saw at the end of the day as the market pushed higher...

The real early warning signal is in HYG's 3C divergences which precede the actual price move, thus this leading 10 min divergence is VERY telling and exactly where we should be at this stage of the move.

Spot VIX was near perfectly in line with the SPX today (SPX prices in green are inverted to show relative performance). while VIX looks like it was whack-a-moled to push the market up in to the close, the tight triangle right under the 50-day in daily spot VIX looks like it's setting up a perfect Crazy Ivan shakeout before making a highly directional move ...

VIX (spot) daily triangle just below its 50-day breaking under the triangle's apex on what I suspect is a Crazy Ivan shakeout, which should see a move to the upside and above the 50 as the market's move finally fails. This may lead to a very interesting VXX/UVXY long or call option trade in VIX derivative ETFs which are high on my list of trades.

Our Professional Sentiment indicator was also not buying this afternoon's exuberance in to the close as you may recall, there was no positive divegrence to push the market higher, there was the VIX smack-down and an earlier a.m. divergence, but this just looks like the playing out of the move we saw set up last week in our forecast linked above and here... IMPORTANT: AAPL Set-up & Market Movement

Leading Indicators: Yields

Yields were also supportive of the market today/intraday as you can see this 30 year leading at the a.m. lows in which the IWM put in that volume spike and the 10 min hammer I posted about earlier today (linked above) as well as leading the market at 1 p.m. as the market pulled up to yields as is normally the case as they act like a magnet and the two reverted to the mean by the close.

Commodities as a Leading Indicator (that is working once again now that QE is over) were in line intraday in the morning, near perfectly with the SPX and then refused to move higher in to the afternoon.

On pour triangle breakout basis, commodities are doing as we expect from leading indicators as 1 of 3 things we are looking for. Commodities are negatively dislocated from the SPX after having been supportive in to last week's forecast, doing exactly what we suspected last Thursday before we even had the first tick to the upside (started Monday).

As for Internals today...

We did get some pretty good intraday volatility which has been sorely lacking the previous 2-days...

We finally saw some movement greater or less than +/- 1250. At the red arrow is this morning's RUT capitulation event on volume and then a couple of moves above 1250, but as you can see from my custom TICK indicator below, the later day rally had weaker breadth...

The Dominant Price/Volume Relationship...

We had another perfect Dominant relationship today, very close to yesterday's of which I said the following...

"The dominance today was strong, 15 Dow stocks, 55 NDX100 stocks, 817 Russell 2000 stocks and 204 SPX 500 (of the 4 possible relationships). All were Close Up / Volume Down. THIS IS THE MOST BEARISH RELATIONSHIP OF THE 4. Often this will lead to the end of a move and a move lower the next day, it's the market's upside running out of steam (via volume) and bearish any way you cut it, even if the averages are up 2% each tomorrow, this is EXACTLY what we want to see in the process of a bounce out of the triangle volatility pinch."

Ironically today's Dominant Relationship was nearly exactly the same, 15 of the Dow 30, 58 of the NASDAQ 100, and 206 of the SPX 500 (of the 4 possible relationships), almost exactly like yesterday and the relationship, Close Up/Volume Down, again the most bearish of the 4 relationships.

The Russell 2000 did have a dominant relationship at 713 stocks, but it was close down / volume down, the least influential of the 4 relationships and the one I have nick-named as "Carry on" as in keep doing what you were doing as we saw Tuesday night which had the same relationship with virtually no movement Wednesday, at least not far out of Tuesday's daily range.

In any case, again a very bearish set of internals.

As for the S&P sectors, AGAIN, 8 of 9 closing green approaching an overbought condition on weak internals. Yesterday I had this to say about a similar relationship in the sectors,

"Seven of nine closed green, approaching an overbought condition which would fit nicely with the Dominant Price/Volume Relationship, it's really exactly where I'd like to see it if we only had a little more upside in the actual price trend given the 3C charts in the averages, the developments in Index Futures starting on 30/60 min charts and some of the Leading Indicators starting to move."

Finally as to Index Futures right now, again they are nearly EXACTLY the same as last night with an intraday leading negative divegrence, see the bottom of last night's Daily Wrap to see what last night's 3C charts of Index futures looked like, then look at the result in this morning's, A.M. Update... an incredible bit of forward looking indications which someone could have done very well with as an overnight Index Futures trader.

Once again, leading negative going in to the overnight session.

ES 1 min overnight leading negative

NQ/NASDAQ 100 futures leading negative

TF-Russell 2000 futures leading negative.

Also the USD/JPY is leading negative going in to the overnight session.

USD/JPY

That will do it for tonight, we are still perfectly on track with last week's forecast and our strategy to use it to let trades come to us.

As usual, I'll check the futures before turning in, but I suspect we may see something similar to the overnight session last night.

Have a great night!

No comments:

Post a Comment