The 7 min charts that are still very much in line with higher USD/JPY are still in place and I would suspect that if we saw a USD/JPY intraday pullback, it would likely make another leg higher unless/until those 7 min USD and Yen futures charts start to fall out of line and diverge.

There were some signs of possible trouble brewing in USD/JPY, although there was no divergence in the pair itself earlier this morning (see the post linked above). The hints of trouble were in $USDX and Yen futures independently.

Since then...

The USD/JPY has put in a sign of trouble with a negative divergence recently (the earlier positive that lifted the pair and index futures which started about an hour after the European open, can be seen to the left in white).

This is the 1 min $USDX chart, you may remember earlier it already had a negative divegrence suggesting a weakening $USD which would likely lead to a weakening $USD/JPY and as it is sponsoring Index futures...

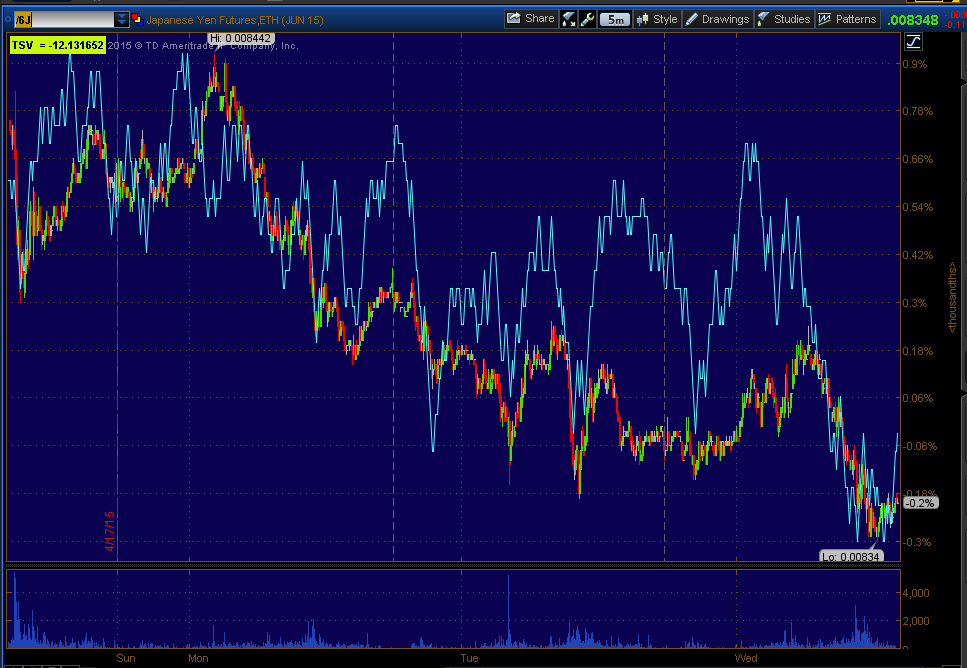

At the same time for USD/JPY to come down, the Yen would need to lift, this is the 1 min positive divegrence in Yen futures which has grown since the earlier update this morning.

It's difficult to say if this is just going to possibly lead to a pullback and then a leg higher in USD/JPY or if this is going to become a stronger and stronger divergence and knock it down and end of story.

The 7 min charts are the line in the sand, you can see them in line again at this morning's earlier post linked above, they still look the same, however...

There has been some migration or strengthening of the $USDX negative divegrence as you can see hints of it on a stronger 5 min chart (the concept of migration of a divergence to a stronger timeframe-stronger divegrence).

For now, we aren't seeing that in the Yen 5 min chart, it is still in line to the downside, pointing to USD/JPY future strength even if there's a pullback.

Yen 5 min still in line and not seeing a stronger divegrence.

For now, I'd say we can't assume too much, but based on what we have right now, a pullback or consolidation short term/intraday in the pair looks more and more probable and for the moment, so does another leg higher.

I did want to mention that there's still a bid for protection. You may recall yesterday's Quick Futures , too large to be retail. They are still building so it seems someone is getting ready for something. I'll update VIX futures and VXX in a few minutes as long as nothing else comes up.

No comments:

Post a Comment