ES 1 min still in a positive divergence at the close of the cash market

NQ one minute

TF 1 min

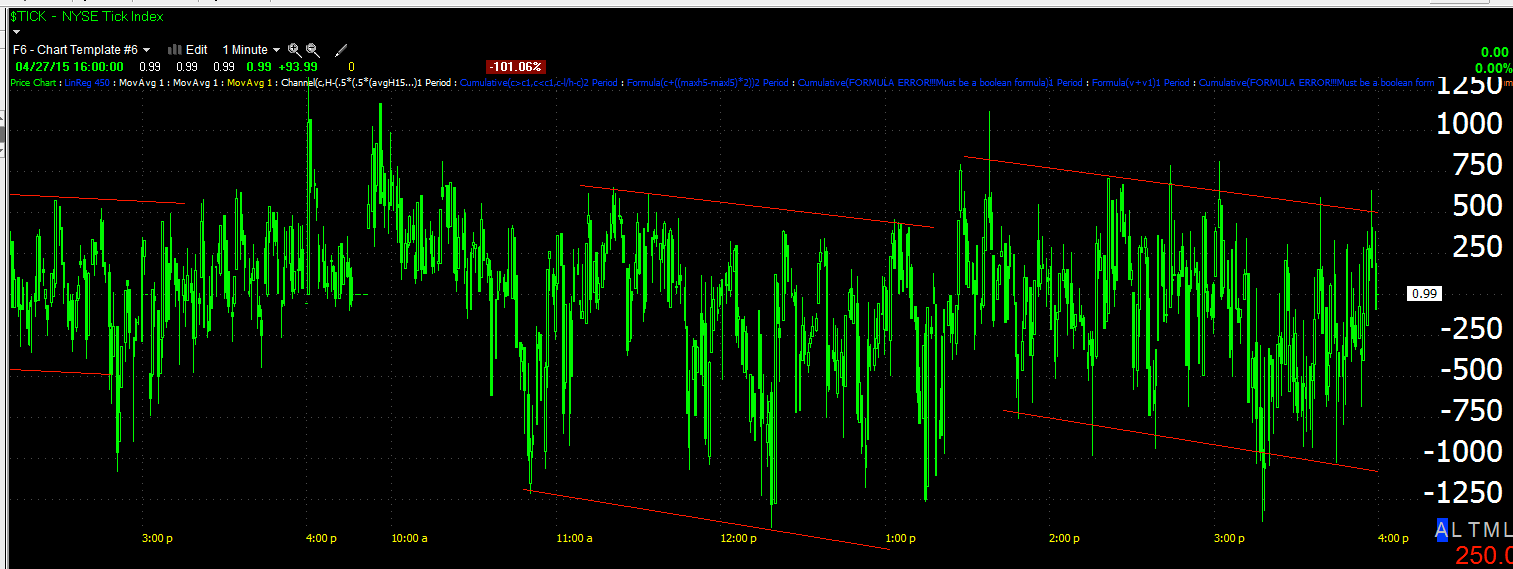

The NYSE TICK index still shows a downtrend in to the late afternoon, however it is significantly such as we saw between 11 AM and 1 PM. Given the circumstances, I would suspect this afternoon improvement is part of the reversal process.

The reversal process as opposed to a V-shaped event is much more common and a rounding or "W" is much more likely to develop as support for any intraday bounce.

SPY 15 min showing a couple of flameout/capitulation events, the most significant are the last 3 candles of the day.

IWM 15 min with something that looks much more like a reversal process with an earlier hammer on volume and another close.

QQQ 15 minutes with what looks like capitulation intraday at the white arrow.

Remember the IYT/Transports post from earlier today, Transports Getting Hard Not To Short Here?

This was the only positive divergence we had as of that post at 1 PM which is why I decided to wait for a better entry to short IYT or perhaps open a put position.

Since then…

This is the one minute chart as of the close.

The two minute chart with a rounding/ reversal process.

And a positive divergence that has migrated out to the three-minute chart.

I've been working from a satellite location as my Internet went down this morning before the market opened so I am going to be transporting my equipment back to my home-base and I will follow up with the daily wrap.

Make no mistake, no matter what the outcome of this area that looks like a small bounce base, I'm glad the weekend posts were put out when they were as considerable damage was done to an already extremely weakened market.

No comments:

Post a Comment