After having gone through most of my watchlist assets, the thing I'm missing is that "beautiful ballet" of the market I described in this weekend's posts, Important Market Update Part 1: The Forecast and Important Market Update Part 2: The Forecast Plays Out & The Beauty of the Market. Granted, it's a very rare moment and one that can occur in a virtual flash in terms of the market, but despite market bounce strength today and the failure of that as expected on such a tight "W", I'm not seeing the watchlist assets/trade-set-ups all coming together.

You can see how we forecast the bounce yesterday and below you can see the weakness developing in to today...

TICK intraday has been stronger on the whole, but is starting to deteriorate a bit now which fits with the intraday 3C charts as seen below and from recent posts...

IWM 1 min leading negative

QQQ 1 min leading negative

QQQ 30 min triangle and breakout with a negative divegrence at what we expected to be a head fake, so far good confirmation of exactly that.

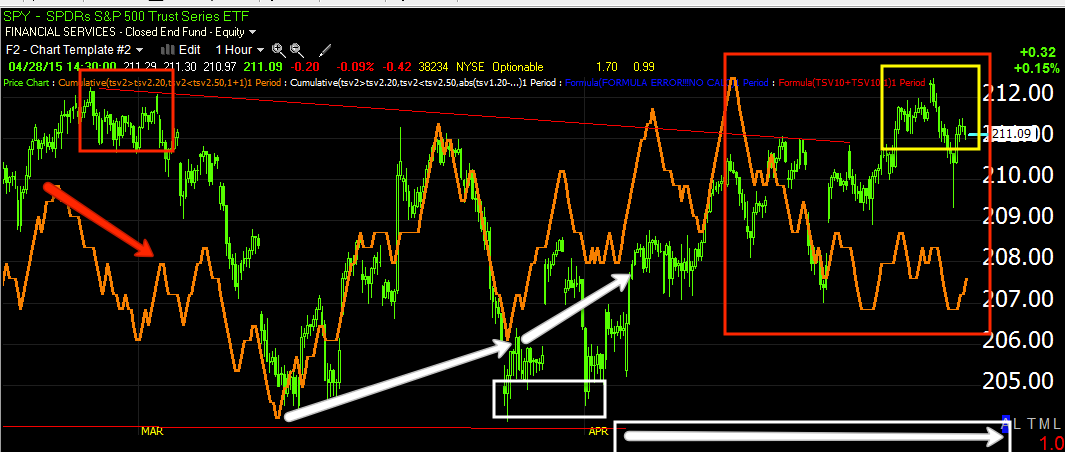

SPY 60 min and breakout from the triangle, once again good confirmation of the triangle breakout being a head fake move as there's 3C distribution in to it on a strong 60 min chart (note the accumulation area, the exact same area I have been showing over and over.

In addition, the intraday Index futures charts have been going negative just like the averages, foreshadowing the market/price action intraday.

However, remember what 1 of the 3 final conditions was, the 7, 10 and 15 min Index futures charts all negative. They are all over the place in those timeframes, some positive which was from yesterday, a continuation of strength for today's "V" shape reversal, some negative, some in line, but not that ballet that is unmistakable, which is why I have not been throwing trade ideas out there today.

I'll continue to monitor the situation and update you as soon as I know more. The overall trend as seen on the 30/60 min charts above are right in line with expectations, the forecast and what we expect next (a larger leg down), however right now, it seems maybe they're trying to keep the market as close to neutral until the F_O_M_C.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment