As for USO, long term members probably know what the gist of expectations are, newer members probably don't so I'm going to just briefly touch on them, let you see the most current charts and what I'm looking for as there's a partial/Speculative USO 8/21 $17n cal trade idea out there that I would add to if I saw the right mix of scenarios come together.

This is a base-like structure (stage 1) that appeared after the downtrend from last summer's H&S top/distribution and downtrend in oil, then it turned sideways indicative of a base. Speaking of head fake moves, March 18th saw a stop run below support which immediately led to the bounce above the range which we expected to come back down in to the range allowing crude to be accumulated at lower prices and the base to strengthen. Crude finally did come down as we expected with a break of the range(chop) around $19 about 2 weeks ago. I've ultimately been looking for a move down toward the $16.00-$16.50 area for the base or signs the base is finishing up, which should create a primary trend reversal to the upside in oil, but as with any asset, we want strong confirmation of our expectations before entering positions.

Locally and near term it looks like Crude has been consolidating in this area for a bounce/gap full kind of move and that's what the USO call position is all about.

Remember those head fake moves which would be below support and tag stops, that;'s what looks like happened at the yellow arrow and the day before as volume increased as intraday trade hit stops.

The short term intraday 1 min chart has a decent positive divergence in the area where our head fake would have occurred.

This 5 min USO chart also looks to be more positive in the same area,

At a 30 min chart, there's no such divergence and this is much more in keeping with the move eventually to the lower end of the large range.

The 60 min USO chart confirms. These are the charts we want to see go positive near the lower end of the range and that will set up a possible long term , primary trend long position.

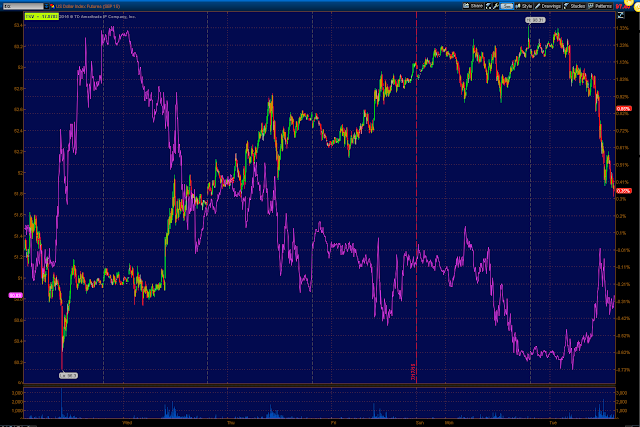

Generally speaking there's a legacy $USD arbitrage correlation between the $USD and $USD denominated assets such as oil.

If you saw yesterday's FX-Market Correlation / Divergence then you know I'm expecting even more downside in the $USD in coming days, which means...

This rough inverse correlation between the $USDX (candlesticks) and Crude futures (purple) on a 60 min chart or...

A closer look on a 5 min chart, "should " see the $USD make a move lower and as such crude higher. Of course there are extraneous events such as the recent Iran talks/deal, oil inventories of which we have one tonight after the bell (API) and another tomorrow morning at 10:30 a.m. (DOE/EIA Oil Inventories). However for the most part, I'd say the probabilities favor a bounce in crude.

I don't want to add to the USO call trade idea which is half size/speculative until I see some stronger charts that really stand out which means we could miss the trade in waiting for that stronger confirmation, but we still have a partial position and this really isn't a large trade, more of a gap fill/./bounce.

I think it's worth waiting for, if the charts really start to pop, it's probably worth taking a look at the extra risk (add-to), if not, then I'm content to let the current scenario play out, however once again, you saw the posts yesterday, I do expect the $USD to move lower and that is a big influence on the price of oil which moves opposite the $USD for the most part as seen above.

No comments:

Post a Comment