WOW! Last night I warned about strength today, even in the face of a gap down-that's a hard call to make, seeing a gap down like that and saying, "but we'll see market strength". The only way to have confidence in these calls (How about HOG today? Several members eamiled me today that made money in HOG and a few other trades based on the market call) is to trust your indicators, I trust mine. However, accumulation is one thing, but the strength of today's move can not be overlooked. In Western terms, this is what is known as a "Key One Day Reversal", in Eastern, candlestick charting terms it's known as a Harami reversal (day 3 and 2) and today (day 1) is a "Bullish Engulfing" candle. The volume was up, not on par with the massacre on Friday, but up substantially from yesterday. The price/volume relationship as you can see from the chart below, was Price Up/Volume Up, the most bullish of 4 configurations.

The only thing not annotated is yesterday in the white box, this is the Harami Pattern. Today we got Price Up/ Volume Up, and a strong candle on volume. This is surprising to see as a correction, the configuration usually leads to a more substantial move. Friday did create a one day oversold configuration which is rare, now we are seeing almost equally volatile price action today. This is why earnings and tops are so difficult to trade.

Good thing to remember, the close of the previous day is typically the first zone of resistance/support. Note volume picking up as it crossed through resistance. A couple of things happened, longs jumped into the trade there and shorts covered there. This is exactly why I say to keep your stops in your head, putting in a stop with your broker is showing the market your hand. Typically at 3:30 on toward the last 10 minuted of the day, we'd expect to see day traders closing out positions and a little but of a loss of momentum. With all the new developments including algo trading and prop firms being shut down, day traders don't have the same influence on late day trading. So we saw a very strong close, we also saw a very bullish price volume dominance of Price Up/ Volume Up which is the most bullish. Taken with the successful Harami reversal and the engulfing candle/ Key one day reversal, this was a strong day. I expected strength today, I really had no way to say it would be this strong.

This 5 min 3C ver. 3 was the most accurate in calling today's move. You can see a strong positive divergence toward Monday's close. I find it strange with all of the other apprent strength today that this 3C chart was not able to make a new high with price. This is, of sorts a somewhat weak relative /negative divergence, but it suggests to me that there's some fading momentum, not downright distribution. This leaves the gate open for more upside in my opinion. However, as I mentioned before this move up got started, I anticipated a couple of days of upside.

This 3c ver.1 5 min chart of the SPY shows a positive divergence at this morning's lows and the rest of the day it confirms the price trend. It is rare to see a positive divergence in an uptrend, although they do occur, so this is actually a fairly strong chart.

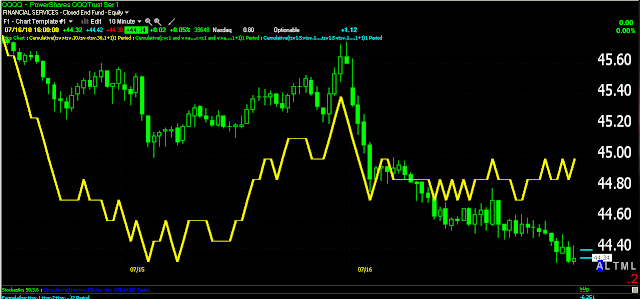

This same 3C chart, except 10 min has been pretty reliable in the past. This is the first timeframe in which we see a negative divergence, which I would interpret as the start of selling into strength, but not an imminient reversal. Of course smart money's not always smart-Lehman Brothers comes to mind, however, I find it hard to argue with the evidence. It seems to me that we are in for at least two more days of upside, unless we see a lot of selling in the 1-5 min charts tomorrow, it wasn't really there today.

Here's something interesting, the SPY 5 min 4C chart, which provided a leading positive divergence Monday, a very pronounced one. In looking at this chart yesterday, there was very little chance of not seeing upside today. It has formed a mild relative negative divergence between yesterday's close and today's close. This is really the strongest case I have toward distribution and it's fairly mild.

Now that I've posted so many charts that seem to not give us much perspective on the market, I will explain why.... The name "3C" stands for "Compare, Compare, Compare"-it's a reminder of what good analysis is all about, comparing, putting together as many pieces of the puzzle as possible. The point I'm trying to make other than, brace for more probable upside , is that we do not see consistency between the indicators like we did yesterday. I call this the fog or the Bermuda triangle, this is a situation where any call is not backed up by high statistical, objective probabilities. IT makes me nervous to say anything regarding market direction as there are a few different doors open and it's most likely because all versions of 3C/4C are written differently precisely so I do not get the same signal unless it is very strong, then they align like yesterday or today's move in HOG which could be seen with quick view.

So lets look at what this could mean

Although the market is good at manipulating price patterns, the bigger patterns such as this Head and Shoulders are very dificult to manipulate. This is a consensus of human emotion. It's a stage 3 top of proportionate size found where it should be expected with 3C daily charts confirming it. People talk about the failure of the Head and Shoulders May-July last year, but they didn't take the time to validate the pattern. It has been said that one of the main attractions to technical analysis is laziness and that is what happened back in 2009 with the H&S, YOU MUST CONFIRM THE PATTERN WITH VOLUME and in this case, we have confirmation. The greeen arrows are pointing down, this is volume n the rallies, the red arrows pointing up is volume in the sell-offs, this is what confirms a Head and Shoulders top. It's difficult for me to believe that this top will be voided. So if the market rallies the next few days, you know what to look for-VOLUME! If it dries up like we have seen in every other rally during the top, then this is not a serious threat to the top and the short position is justified. If it does increase in volume, if it surpasses the blue arrow and most importantly the red arrow above price, then we have a problem with this top.

Many have talked about the "Summer Rally", even people I respect. It's almost a Wall Street cliche now it's so embedded into our technical brain. There have been years, even in Bull markets like 2004 where we didn't see a summer rally. In 2008, at the right edge of a Head and Shoulders the summer rally that started late July was worth about 3.5%-not a very big deal especially considering the fact that Friday we saw a one day move that was nearly equal to the 2008 summer rally. The point is, your analysis sholdn't be based on superstition, but objective data.

Bottom line, we watch carefully tomorrow for any indication of a halt to higher highs, higher lows. We watch for volume, does it increase or decrease? Of course I'll be watching developments in 3C, but to remind you of the most powerful and telling of all the charts,

This is the grand daddy. In the green box, TSV largely confirms the trend, except the orange box within it, we see the distribution start in October-same as the blue arrow on the 3C chart. The red boxes both show extreme leading negative divergences, these would be exceptionally difficult to turn at this point, something amazing would have to happen in the economy. So keep in mind the long sighted view as well.

As fr the next few days, continue to honor your stops, no cheating and moving them up unless you have an exceptionally good reason-you can always short at higher levels and recoup any losses taken by stopping out. Take a small loss and you won't be faced with taking a large loss. Learn to love taking small losses, that's your survival mechanism in the market.

If you have the time and are nimble, you can certainly play some longs. Several members emailed me with long plays they made money on today including HOG as I warned last night we'd see upside. One of my favorites for a quick bounce is UPRO, it;s 3X leveraged, you don't have to worry about earnings or news really and it'll generate a nice little return in an quick pop up.

Now, looking forward to tomorrow's earnings as people have been making money on this new twist I've thrown into the mix.

JNJ did what was predicted in last night's call-it was down on a nice gap and there was downside off the opening, not that it's a high beta stock, but 3C was right on. And b the way, it broke the flag, so watch for the target to be met. GS wasn't much of a call, the biggest thing there was, "as GS goes, so does the market" and that's what we saw in price configurations today. HOG was a huge success, like DAL the day before.

As a quick possible trade of a day or so, because after that it's murky, USO appears that it will see some downside tomorrow-watch for a possible gap up that falls back into the triangle. If that situation unfolds, this may be worth more then a day or two, a false breakout in USO right now will most probably create a downside sell-off that would be worthwhile.

Now please keep in mind what we are doing here with these earnings calls (I NEVER used to trade or recommend trading earnings), we are trying to find possible leaks that the market is acting on before the earnings come out, this is the first time I've used 3C for this and quite honestly it's pretty tricky, so don't go betting the farm. First up in Altria (MO), which I'm ashamed to say that I have contributed to their sales this year, I may have even made their quarter :( Please no emails, I know, I know-but all traders smoke, right?

This 4C 5-min chart has been accurate and honestly I like the stocks that are reporting early because you'd expect to see the final exodus the day before in the afternoon. I think they come out at 9 a.m. Notice the sell-offs around the $21.45 level. There's been about 7 day of resistance there and it seems to be coming from the late April, very early May top that formed right before the sell-off. then we saw a move above in mid-May, it didn't hold and was an obvious false breakout. Why obvious? Look at what happened next, it took a 10% nose dive-false breakouts reverse quickly and violently and in this case, on big volume. Today MO broke out, any other day and I might feel differently about it, but it appears that they used the market strength to perhaps create one more false breakout, one more opportunity to sell at higher prices and set shorts. 4C could not confirm the afternoon close higher. My opinion is that this will not do well whatever the earnings are, the only wild card is the "rising tide lifts all boats" meaning general market strength, still, I feel this is probably a bull trap today. Otherwise it seems to be a decent short on a longer daily basis.

BIDU has negative divergences on 3 different time frames, even MoneyStream in red is divergent. I'm expecting weakness here. Even today as it moved up with the market, it could not muster any volume. It's also in a daily triangle-looking top.

FCX 1 min 4C chart. All 3 3C charts are negative on the 1-5 min as is the 4C chart you see here, price rose with the market, but it seems apparent that there was selling into that gain while the rest of the market at least confirmed. FCX should report pre-market. If you get a chance, look at the last 30 minutes where it actually starts making lower high/lower lows=downtrend on high volume. I think this is a pretty good candidate for a short-sell trade.

Good News?

This is a 10 min 3C chart of GSK, 10 min is pretty substantial and you can clearly see the positive divergence yesterday and today we have a leading positive divergence, the most powerful and on a 10 min chart. I feel that this one is going to respond well to earnings.

Finally, for tonight-this is the one I'd rather skip, but this is one stock that will be or has the ability to be the fulcrum of the market-UTX

On a daily chart, UTX looks remarkably like the S&P-500. There's one difference-this 4C chart does not look like the SPY. We have the positive divergence yesterday, but today toward the close, actually earlier then that, we see distribution. There's also some bigger negative volume and this is what has me a little hesitant. Although the assumption I'm making by putting this chart in this section is that earnings leaked, the volume at the end of the day could have influenced 4C. 4C is meant to pick up on quiet accumulation/distribution, but the anomaly in volume could effect it. The reason I went ahead any way is all the 3C 1-5 min charts are negative and the divergence started before the volume really got heavier at the EOD. So the assumption here is we have a possible leak in UTX regarding earnings and it won't respond well. If that is the case, this one could very well influence the market. UTX reports pre market.

Happy Hunting