Here are a few of the charts that developed today right around the time the New York F_E_D conducted a Permanent Open Market Operation (POMO) for between 1.5 and 2.25 billion, there's another tomorrow for $4.25-$5.25 billion. Because the F_E_D can't directly participate in Treasury offerings, they buy them from the banks in the secondary market, the banks can and have in the past, taken that profit almost immediately and drove stocks higher during QE1, but especially QE2.

I don't know if that is what is going on here, the F_E_D will also be selling short dated treasuries in other operations on other dates, here's the schedule.

While the stated goal is Maturities Extension (buy long data Treasuries and sell short dated), it doesn't look like the operation is 100% sterilized (meaning no new money enters the system) and who's to say the banks can't use the money quickly in and out of the market. I really don't know the answer, but I'll be looking for clues and hints.

Today alone may not have been enough to warrant taking action to lower risk, but many assets like AAPL I was already moving out of before these strange signals developed and fast.

I'll show you a few and then where I really found them to be both accurate and strange, in the Equity Index Futures.

AAPL 5 min chart was moving perfectly in a negative fashion, today it started seeing n intraday positive divergence, it's still in leading negative position, but this is a 5 min chart that saw decent activity.

The reason I feel fine about being short AAPL stock rather than options right now is this 15 min chart is horrible, AAPL should see a massive decline based on this and an equity short is not going to produce andy significant draw down risk, timing isn't an issue, time decay isn't an issue, I believe you short AAPL and wait for this signal to be fulfilled, you have a nice AAPL trade.

The 1 min chart was acting better than it should, I didn't say good, but better than it should. This could be some small time support to keep AAPL range bound, it also could be some support for a move to fill a gap higher, I don't know, it did deteriorate very quickly late in the day. If AAPL sets up again for a Put position and it looks very high probability, I'd love to see everyone make 30% or 115% like the last AAPL options trade; the last two have been successful because we have been patient and demand a higher standard in the signals.

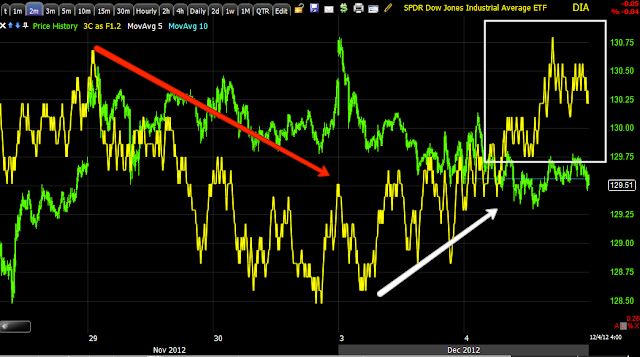

The DIA 2 min chart was moving in the right direction, yesterday's positive divergence wasn't that big, it wasn't much of a concern, but when it started leading today, I have to back off a bit and see if this is a one day event or the start of a bigger trend.

DIA 3 min saw a leading positive divergence as well, so there was migration across the timeframes, not good. There was late day deterioration, but was that the typical end of day profit taking, traders going flat overnight or something else?

Until I can answer that question, I must warn you and encourage some caution.

The IWM 1 min looked horrible, especially next to some of the other charts, this is why I felt ok with a put position there, among other charts.

The 2 min was initially concerning as it hit a leading positive divergence, but that went negative and the timeframe before it, the 1 min (which is where any changes to the 2 min would show up first) looked bad.

There are a lot of negative timeframes in the IWM, but with a 60 min negative like this, that's some serious damage that I don't think can be repaired without a pullback, if they don't want to own the IWM up here and are distributing, why would that change unless price created a new dynamic?

QQQ 1 min initially caused a little concern, this isn't that scary of a positive divergence on its own, but with some of the other averages and stock, it takes on a different hue in that atmosphere.

The 3 min didn't see the strength some other 3 min charts saw and in fact went leading negative, this is part of the reason I also felt ok with short exposure in the QQQ.

This 5 min chart became a bit concerning as well earlier, but it finished the day pretty close to in line, had it led to the upside in the last 15 minutes, I couldn't get warnings out fast enough.

QQQ 15 min almost demands lower prices as it leads negative.

As does the 60 min, there are only a few averages negative out to 60 min, this is one.

The SPY was especially concerning with a leading 3 min positive divergence this still suggests a decent mov higher in the next day or so.

If that be the case, then flattening out risk makes sense and re-entering at better prices on strong signals is smart trading, these are the kinds of signals 3C can give that give us an edge that most other people have no way of knowing, all they see is price kind of consolidating.

A leading positive 5 min on the SPY as well and remember, most of these developed after 1 pm, so in many cases what you can't see on the chart (only in real time) was how fast these divergences were building up, that was pretty scary.

Here's the REAL trouble; the 5 min S&P Futures 3C chart.

This is a clear negative divergence from last week, one of the reasons I liked the idea of adding some shorts Friday including AAPL Puts and FAZ calls, look at that negative divergence at the highs of ES, which had already been showing a negative tone last week, now move forward to the present...

ES fell 23 points so far the last 2 days, that's a signal that worked VERY well as that's a big move for ES, however if that signal worked so well, then what of this 5 min leading positive divergence today?

Here are the charts in the same areas for the NASDAQ Futures...

This is last week and in to this week's high, negative...

And NQ falls sharply this week, but puts in a rather large relative and leading positive divergence.

These two charts are the most concerning for the very near term (like tomorrow). While I may not have all of the information yet, I can't in good conscience withhold information like this from my members because I can't completely explain or understand it. The signal is there and that's enough for me to warn.

There were some other indications I didn't like today such as credit, yields, a few currencies even though there were reasons, I thin leading indicators on their own would have caused me some concern, throw in the above, it looks like something is shifting quickly, maybe this is just a bounce to fill some gaps and we see a very bad move down , but I want to have those signals in hand. We can always re-enter a position, we can't always undo damage that we didn't move on.

The last thing that was bothersome is I didn't and still don't know to what extent these signals are in the market, I need time to look through a lot of charts.

So while I do not like making rushed calls with little information for you, I must warn you when something is off. This may all work out as expected and this may be a blessing we don't even realize yet, but there are many other things it could be as well. We trade the highest probabilities, not guess or play a market version of pin the tail on the donkey.

More as I uncover it.

No comments:

Post a Comment