It has been a tough week for signals, although they started to improve late yesterday and I suspect that's because the Greek default that was set for today was all bundled up with the rest of their June IMF payments and instead of $300 mn Euros due today which they don't have, it will be $1.5 bn Euros at the end of the month which they don't have, but it bought them some time so the F_O_M_C on the 16th and 17th will be the next big event.

In the mean time, I suspect signals will continue to get better now that everyone's not standing on the sideline waiting to see if Greece defaults today.

I did consider opening a hedging VXX put for the VXX and UVXY longer term trend long positions, but I can't find enough decent evidence on the charts to justify it. There are some charts, especially futures that point towarrd the kind of bounce I thought we'd get this week, the kind of bounce that fulfills last week's The Week Ahead, but again there's very little evidence for that either unless the market does some serious work next week.

In all the charts you consider, you have to consider the What High Yield credit is Screaming post.

So far, there's not much at all that even looks as decent as yesterday, for example...

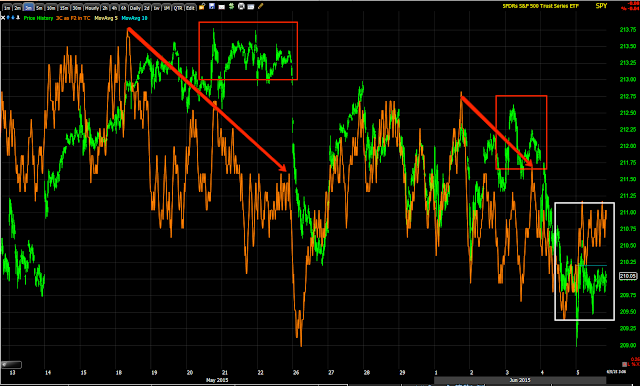

SPY 1 min intraday looks worse than yesterday. This does NOT look like it can support much if any bounce in to next week, so as I said, unless there's some additional short term base work put in, this market is looking dangerously close the the edge of the cliff.

This SPY 3 min chart reduces some of the noise and gives a bit better look at the trend, still there's barstool anything there to support a bounce at all.

Put the same chart in context of its trend and you can see how minor that chart is.

Not to mention the larger trends like 10 min charts that are just getting worse and worse.

Or clean up the noise and the entire year of 2015 shows the trend of 3C really falling off a cliff.

I was hoping we'd get in to some of those shorts before then.

The QQQ / IWM aren't any better.

QQQ 1 min is about the best it gets at this point which is not very good.

Compared to the larger 10 min trend and a much stronger chart, I'm sure you are getting the drift.

The IWM intraday charts look like this, if anything I'd expect early weakness early next week as there's no confirmation at all here and it's not just this 1 chart.

This is a 2 min chart just to prove it. As for the trend that has been developing, IWM 2 min shows even the confirmed downtrend to the far left looks better than the charts right now.

And the larger 15 min trend, well that has been bad, it's when the short term timing harts start falling apart that you need to be concerned (you're long).

Meanwhile the VXX trends in the same timeframe are strong, 10 min leading positive and further out.

As for the watch list stocks, I've been going through them all day and interestingly they don't seem to be waiting for the market for their set ups like the NFLX one posted Wednesday, NFLX Trade Set-Up

NFLX is doing what we need it to do without the market.

So far it is in line and needs to break a bit higher. However others like Transports probably don't have much left...

The Transports 60 min bounce that a year ago would have gone on for weeks and strongly...

It's starting to fade, although I think we can still get a better position a bit higher before it ends.

Again, unless there's some MAJOR work done early in the week, I think we'll be just taking what we can from the watch list of assets that are setting up on their own with no market support.

It's really not these charts that are as bad as they look, it's the HY Credit that's really screaming Bloody Murder for this market.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment