GM is not a stock I'm very interested in trading, but I think it's a great opportunity to watch how 3C/GM/and the market all come together with a stock under known accumulation.

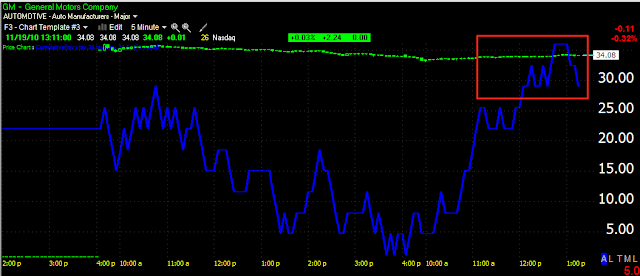

GM started trading at $35, being we are below that and 3C is making a new high on this 5 min chart, we are looking at an automatic leading positive divergence.

Interesting, we know the institutional sponsorship came right at GM's lows this morning as it threatened to break $33, the 1 min chart shows what I'm assuming is probably the market maker stocking up on an order or front running a larger institutional order they knew was coming, thus the white arrow showing a 1 min positive divergence. Right now we have a 1 min negative divergence suggesting a pullback. Remember though, the leading divergence (because it's leading and because it's a more important 5 min chart) takes precedence over the continuation of the move. So my assumption is this tells us there's a buyable pullback coming and a high likelihood of the trend up continuing.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

2 comments:

So, er, Brandt, last night you said that oil has a further run up to go? and that silver was looking negative. Well, oil is down and silver is up.

So er, Mr Pink, here's last night's article http://wolfonwallstreet.blogspot.com/2010/11/daily-wrap.html#links

I didn't mention either oil or silver.

Post a Comment