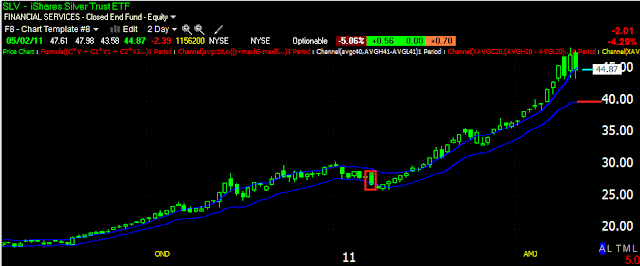

Today's intraday SLV action, a slight positive divergence on the open which filled a good portion of the gap before going negative. At the green arrow we have lower lows or confirmation.

The daily candlestick pattern is a commonly seen reversal set up.

First target easily hit, the second is the deeper blue 22 day m.a.

This daily trend channel held the visible trend, the red arrow was close to a stop out, but not quite as there was no close below the lower channel so it can be used to gauge the character of the current uptrend, if it is broken, we know we have something unusual, however a deep shakeout would probably need to be aggressive.

I would be a little more concerned if this wider channel was broken, otherwise, I'd be looking at a healthy shakeout as an opportunity.

For now, it seems SLV will continue its pullback.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment