First let me apologize for the length of this post, but it's important.

SPY 30 min in line as well.

The 15 min chart is still positive, it's in leading position

The 10-min chart is showing some weakness as it starts a slight leading negative, if this filters in to the 15 min chart, a reversal is nearby.

The 5 min chart is negative today and as you'll see below, it's not surprising.

Here's the relevant IWM chart, 1 min leading negative divergence. The selling started late yesterday afternoon.

Here are the Q's on a 15 min chart, in a negative and leading negative divergence, this is why yesterday I said that if was using leveraged ETFs, I'd sell TQQQ and put the money in to financials.

QQQ 10 mn also in a slight leading negative divergence. To be clear, there are relative divergences that compare two similar points in price with two different readings of 3C, a leading divergence is more powerful and leads price.

QQQ 5 min, started going negative yesterday as Tech went out of rotation as per my post of Tech vs Financials regarding sector rotation. Today, the pop at the open, due to AAPL, was promptly in distribution, this is also a leading negative divergence.

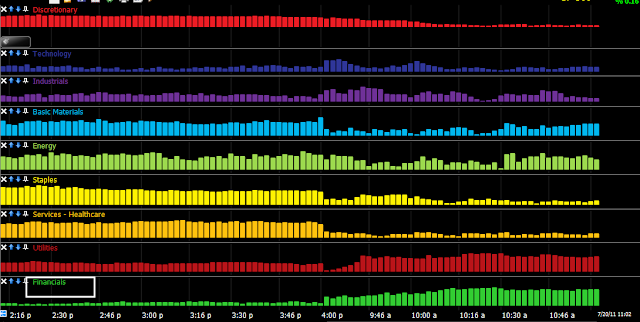

Here are the recent movements in sector rotation. As you can see, Financials today have taken over the role of leader, this was evident yesterday and why I made such a fuss over it and hanging short term ETF positioning to take advantage of financials coming in to rotation. Note most of the other sectors are going out of rotation. Basic Materials in light blue has a chance, consumer discretionary, which judging by simple common sense would be the first to go, looks the worst. Energy is a possible white knght for the bounce, but it's a bit ambiguous. Financials alone cannot support this bounce and that is why we are seeing such a lack of performance today.

Lets look at the sectors

Materials, not performing, I don't see much hope there ether.

XLE is close to unchanged and as I said a bit ambiguous, it could go ether way, but the energy omplex s large enough that combined with ongoing strength in financials, the bounce could be kept alive a bit longer. When financials fade, this bounce is almost certainly done.

As I mentioned yesterday, Financials which were underperforming, came in to rotation and are the only thing holding the market up at this point.

Here's the 15 min chart which suggests some more strength in financials.

The 5 min chart is showing what looks to be a pullback coming (by the time I post this it will probably have happened.

Industrials are flat

However the 5 min 3C looks like they are going out of rotation, probably not much hope there.

As I warned yesterday, "get out of tech and in to financials", tech is underperforming at resistance.

Consumer Staples don't look like they'll come back from their decline out of rotation.

The 10 min 3C chart is confirming this with a leading negative divergence.

Utilities are showing some relative strength price wise, but...

The 10-min hart is going negative on them as well.

Healthcare s another possible white knight for the bounce, although underperforming now, there's been some improvement.

Here Healthcare is about in line on the 15 min chart, the pullback looks a little worse then 3C.

Consumer discretionary, as mentioned above has fallen apart, this is the first to go.

Here's the 1 min chart, absolutely falling apart today.

So, unless Energy steps up and financials maintain, I think we are getting close to the end of our bounce. Last week when 3C predicted the bounce, there was no way of telling ho long t might last, we'll have to monitor the situation, but I would be taking some profits and certainly looking at entering some shorts, even f you are just dipping your toes in the water. Make sure the particular short you choose makes sense and isn't just any idea out there. You can always email me for a second opinion.

Sorry for any spelling errors, both of my fingers are pretty sore from typing (note I said both-that's what happens when you goof off in typing class and end up being a two finger hunt and peck typist).

No comments:

Post a Comment