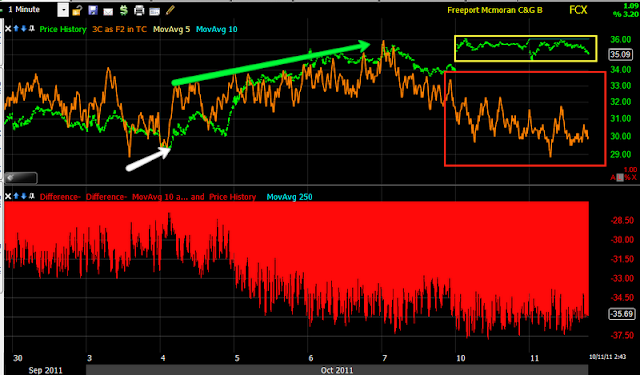

Here's another commodity (copper), although this is a copper stock) that tends to lead the market. It's not having a great day today.

FCX 1 min-nice flat trading range, typical of distribution. You can see accumulation, confirmation and a leading negative divergence.

FCX 5 min shows the same, a base, confirmation of the uptrend and a leading negative divergence-very ugly.

FCX 10 min shows 2 negative divergences, the first brought it down a bit, the second is happening now.

FCX 15 min negative divergence. Also you can see the last top and accumulation at the bottom.

FCX 30 min shows the same cycle, a relative negative divergence the last 2-3 days and it's just starting to turn to a leading negative divergence.

I meant to show this one yesterday as I had seen some signs.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment